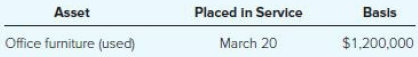

Woolard Supplies (a sole proprietorship) has taxable income in 2018 of $240,000 before any depreciation deductions (§179,

Question:

a. If Woolard elects $50,000 of §179, what is Woolard€™s total depreciation deduction for the year?

b. If Woolard elects the maximum amount of §179 for the year, what is the amount of deductible §179 expense for the year? What is the total depreciation that Woolard may deduct in 2018? What is Woolard€™s §179 carryforward amount to next year, if any?

c. Woolard is concerned about future limitations on its §179 expense. How much §179 expense should Woolard expense this year if it wants to maximize its depreciation this year and avoid any carryover to future years?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Question Posted: