Financial theory says that stock prices are negatively related to the unemployment rate and interest rates. The

Question:

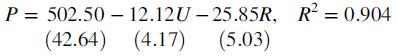

Financial theory says that stock prices are negatively related to the unemployment rate and interest rates. The following equation was estimated using U.S. data on the S&P index of stock prices (P), the unemployment rate (U), and the Treasury bond rate (R):

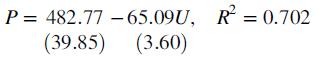

The standard errors are in parentheses. During the period studied, the Federal Reserve used high interest rates to weaken the economy (and reduce inflation), and used low interest rates to stimulate the economy. As a consequence, the unemployment rate and interest rate were highly positively correlated. To cure this multicollinearity problem, the researcher omitted the interest rate and obtained this result:

a. Explain why this cure for multicollinearity is worse than the problem.

b. Explain why the coefficient of the unemployment rate is lower in the multiple regression equation than in the simple regression.

Step by Step Answer:

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith