Two portfolios were followed: one portfolio consisting of stocks that were deleted from the Dow Jones Industrial

Question:

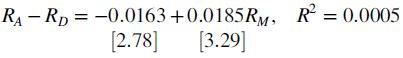

Two portfolios were followed: one portfolio consisting of stocks that were deleted from the Dow Jones Industrial Average, the other portfolio consisting of stocks that replaced them [25]. Whenever a Dow substitution was made, the deleted stock was added to the deletion portfolio and the replacement stock was added to the addition portfolio. Using 20,367 daily observations, the difference between the daily percentage return on the addition portfolio RA and the daily percentage return on the deletion portfolio RD was regressed on the daily percentage return for the stock market as a whole:

There were 20,367 observations. The t values are in brackets.

a. Explain why regression to the mean suggests that stocks removed from the Dow may outperform the stocks that replace them.

b. The average value of RM is 0.0396 percent (this is not 4 percent, but 4/100 of 1 percent).

What is the average value of RA − RD?

c. Is the average value of RA − RD large or small? Explain your reasoning.

d. Test the null hypothesis that the slope is equal to 0.

e. Test the null hypothesis that the intercept is equal to 0.

Step by Step Answer:

Essential Statistics Regression And Econometrics

ISBN: 9780123822215

1st Edition

Authors: Gary Smith