A universe of securities includes a risky stock (X), a stock index fund (M), and T-bills. 6.4

Question:

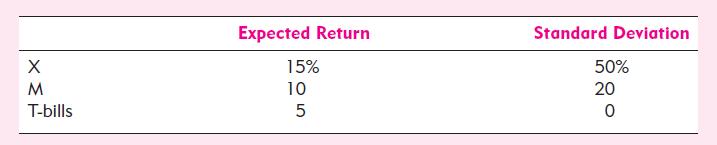

A universe of securities includes a risky stock (X), a stock index fund (M), and T-bills. 6.4 The data for the universe are:

The correlation coefficient between X and M is -0.2.

a. Draw the opportunity set of securities X and M.

b. Find the optimal risky portfolio (O) and its expected return and standard deviation.

c. Find the slope of the CAL generated by T-bills and portfolio O.

d. Suppose an investor places 2/9 (i.e., 22.22%) of the complete portfolio in the risky portfolio O and the remainder in T-bills. Calculate the composition of the complete portfolio.

Transcribed Image Text:

X M T-bills Expected Return 15% 10 5 Standard Deviation 50% 20 0

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

a Implementing Equations 65 and 66 we generate data for the ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Forward Propagation: Consider a neural network shown below. WX11 WX21 WX12 X1 WX13 hi Wh Wh h2 WX22 X2 WX23 h3 Wh3 20 It has an input X = (X1, X2), a hidden layer h = (h1, h2, h3), and an output a =...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

1. Data: This project makes use of annual data for two risky securities: the S&P 500 Index and Gold. Annual values for each of these securities during the period from 1975-2018 are provided in a...

-

How does Apple Inc apply Marketing and Advertising To market their product? Direct advertising Indirect Advertising Social Media (Paid Media, Owned Media, Earned Media)

-

NET how might the following organizations use an Internet chat room for exploratory research? a. A provider of health benefits b. A computer software manufacturer c. A video game manufacturer

-

On January 1, 2018, Harlon Consulting entered into a three-year lease for new office space agreeing to lease payments of: $7,000 in 2018, $6,000 in 2019 and $5,000 in 2020. Payments are due on...

-

Extend the analysis of heat transfer over a wedge flow. Derive the following equation for the temperature profile: \[\begin{equation*}\theta^{\prime \prime}+(m+1) \operatorname{Prf} \theta^{\prime}=0...

-

The County of Maxnell decides to create a sanitation department and offer its services to the public for a fee. As a result, county officials plan to account for this activity within the enterprise...

-

10.21 Estimate the hydrogen-burning lifetimes of stars near the lower and upper ends of the main sequence. The lower end of the main sequence 2 occurs near 0.072 Mo, with log10 Te = 3.23 and log 10...

-

Two portfolio managers work for competing investment management houses. Each 6.5 employs security analysts to prepare input data for the construction of the optimal portfolio. When all is completed,...

-

A three-asset portfolio has the following characteristics: What is the expected return on this three-asset portfolio? Asset X XXN Y Z Expected Return 15% 10 6 Standard Deviation 22% 83 Weight 0.50...

-

Should Harris Corporation accelerate $ 100,000 of gross income into 2014, its first year subject to the AMT? Harris is subject to a 14 percent cost of capital. The corporate AMT rate is a flat 20...

-

It takes one pipe 9 hours alone to fill Moochy's pool and a second pipe 12 hours alone to fill it. The pool is empty and both pipes begin to fill the pool. Working together, how long will it take to...

-

Despite the negative publicity surrounding Uber, consumers continue to use the company's services. Is this surprising? If so, why? If not, why not?

-

It takes a hospital dietician 40 min to drive from home to the hospital, a distance of 22 mi. What is the dietician's average rate of speed?

-

Describe some of the explicit and implicit costs of obtaining a college degree. If two baristas can produce 200 espresso drinks per shift and three baristas can produce 275 espresso drinks, what is...

-

Use the data table to answer the following question. GDP $10 billion Consumption $5 billion Government Expenditures $2 billion Assuming a closed economy, what would be national savings?

-

The amount of time devoted to studying statistics each week by students who achieve a grade of A in the course is a normally distributed random variable with a mean of 7.5 hours and a standard...

-

Propose a reasonable mechanism for the following reaction. OH

-

A 30-year maturity bond has a 7% coupon rate, paid annually. It sells today for $867.42. A 20-year maturity bond has 6.5% coupon rate, also paid annually. It sells today for $879.50. A bond market...

-

a. Use a spreadsheet to calculate the durations of the two bonds in Spreadsheet 1 if the annual interest rate increases to 12%. Why does the duration of the coupon bond fall while that of the zero...

-

A 12.75-year maturity zero-coupon bond selling at a yield to maturity of 8% (effective annual yield) has convexity of 150.3 and modified duration of 11.81 years. A 30-year maturity 6% coupon bond...

-

Why is evidence based research important? What method is used to ensure the correct questions are being answered and the correct evidence collected?

-

Expain the channels and the dynamics of the effects of leverage cycles on policymakers' responses.

-

How to complete these steps using this excel format from the image below. Yearly Sales January February March April May June July August September October November December 2015 2016 2017 2018 2019...

Study smarter with the SolutionInn App