Consider the call option in Example 16.2. If it sells for $15 rather than the value of

Question:

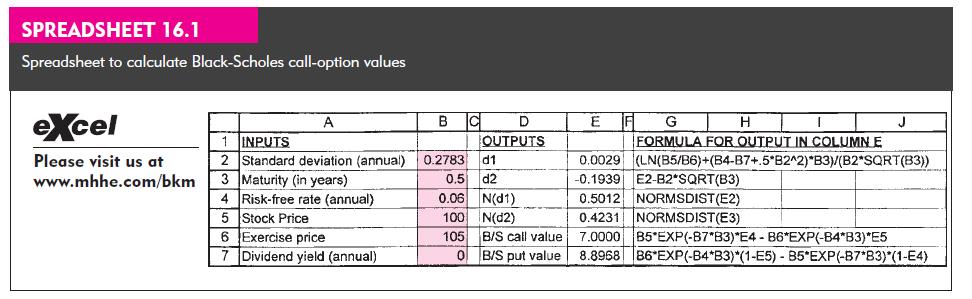

Consider the call option in Example 16.2. If it sells for $15 rather than the value of $13.70 found in the example, is its implied volatility more or less than 0.5? Use Spreadsheet 16.1 (available at the Online Learning Center) to find its implied volatility at this price.

Transcribed Image Text:

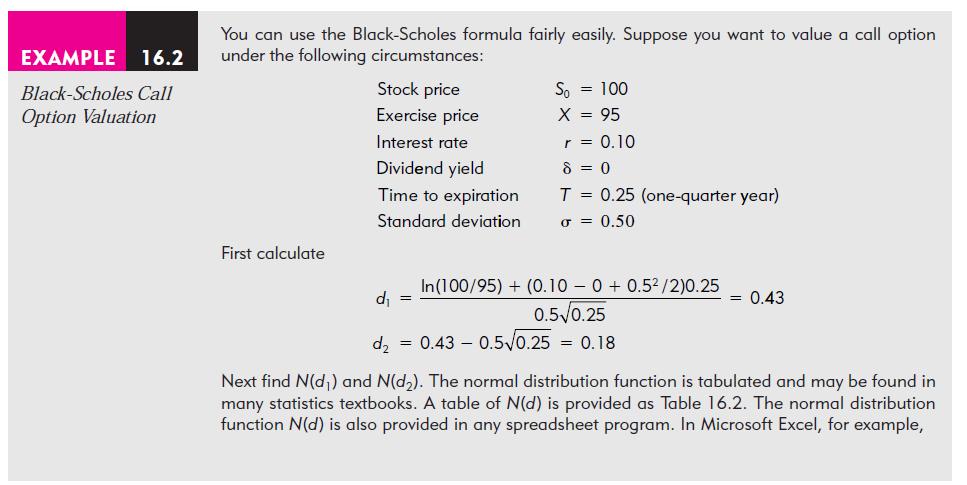

EXAMPLE 16.2 Black-Scholes Call Option Valuation You can use the Black-Scholes formula fairly easily. Suppose you want to value a call option under the following circumstances: First calculate Stock price Exercise price Interest rate Dividend yield Time to expiration Standard deviation d₁ = d₂ So = 100 X = 95 r = 0.10 8=0 T = 0.25 (one-quarter year) σ= 0.50 In(100/95)+ (0.100+ 0.5²/2)0.25 0.5 0.25 = 0.43 0.5√0.25 = 0.18 = 0.43 Next find N(d₁) and N(d₂). The normal distribution function is tabulated and may be found in many statistics textbooks. A table of N(d) is provided as Table 16.2. The normal distribution function N(d) is also provided in any spreadsheet program. In Microsoft Excel, for example,

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

To determine the implied volatility when the call option sells for 15 instead of the calculated 1370 you would need to use an iterative process since ...View the full answer

Answered By

Muhammad Umair

I have done job as Embedded System Engineer for just four months but after it i have decided to open my own lab and to work on projects that i can launch my own product in market. I work on different softwares like Proteus, Mikroc to program Embedded Systems. My basic work is on Embedded Systems. I have skills in Autocad, Proteus, C++, C programming and i love to share these skills to other to enhance my knowledge too.

3.50+

1+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

A company issues a callable (at par) ten-year, 7% coupon bond with annual coupon payments. The bond can be called at par in one year after release or any time after that on a coupon payment date. On...

-

What is the difference between ethical relativism and ethical idealism? How might a person with an idealist ethical philosophy and a person with a relativist ethical philosophy differ with respect to...

-

Welham and Thompson (1997) discuss two possibilities for a Gaussian likelihood-ratio statistic. For arbitrary mean vector \(\mu\), inner product matrix \(W=\) \(\Sigma^{-1}\), and \(W\)-orthogonal...

-

Explain the connection between decision trees and the Describe and Match algorithm. How efficient do you think this algorithm is? Can you think of any ways to improve it?

-

Sally Medavoy will invest $8,000 a year for 20 years in a fund that will earn 12% annual interest. If the first payment into the fund occurs today, what amount will be in the fund in 20 years? If the...

-

Convert the following numbers (Show the steps of your work): a. Ox23734 Binary: Decimal: b. Ob01100011 Hex: Decimal: c. 12345 Hex: Binary:

-

Suppose as in Example 17.5 that oil will be selling in April for $59.79, $61.79, or $63.79 per barrel. Consider a firm that plans to buy 100,000 barrels of oil in April. Show that if the firm buys...

-

Graph the profit and payoff diagrams for strips and straps.

-

On January 1, 2011, the Blackstone Corporation purchased a tract of land (site number 11) with a building for $600,000. Additionally, Blackstone paid a real estate broker's commission of $36,000,...

-

Coleen works for a newspaper in Hamilton, Ontario. Last year ( 2 0 2 2 ) , Coleen expects to earn $ 4 2 , 0 0 0 . How much would she have been required to contribute to CPP ? Ignore the employer...

-

The accountant for Scott Industries prepared the following list of account balances from the company's records for the year ended December 31: Fees Earned $165,000 Cash $30,000 Accounts Receivable...

-

Sharing a compelling idea that could help lower or even prevent drunk driving among teens., provide a concrete idea and follow it up with actionable steps that could be taken.?

-

In your own words, define the following types of reporting entities/structures and provide at least one example. a. Dual-listed entities b. Parent, child, grandchild group structures c. Partially...

-

Lindenwood University, a private university in Saint Charles, Missouri joined the NCAA's Division I level in the Fall of 2022. In December 2023, it announced that it was eliminating ten varsity...

-

Whether pasteurized or raw, both the European Economic Council (EEC) and the U.S. Food and Drug Administration (USFDA) require that milk sold to consumers contain no more than 10 coliform bacteria...

-

A test car is driven a fixed distance of n miles along a straight highway. (Here n Z+.) The car travels at one mile per hour for the first mile, two miles per hour for the second mile, four miles...

-

You are equipping an office. The total office equipment will have a first cost of $1, 75,000 and a salvage value of $200,000. You expect the equipment will last 10 years. Use a spreadsheet function...

-

These can be solved by hand, but most will be solved much more easily with a spreadsheet An unmarried taxpayer with no dependents expects an adjusted gross income of $48,000 in a given year. His...

-

John Adams has a $50,000 adjusted gross income from Apple Corp. and allowable itemized deductions of $5000. Mary Eve has a $45,000 adjusted gross in come and $2000 of allowable itemized deductions....

-

Consider the configuration of current-carrying wires shown below. Two semi-infinite wires carry equal currents I and I2, each with magnitude Io as shown. These wires meet at Point A, where their...

-

2) If you strike a pool ball with just the right amount of back spin, it will come to a perfect stop. (a) What is the appropriate relationship between the initial velocity, vi, and the initial...

-

Surgery Center is an outpatient surgical clinic that was profitable for many years, but Medicare has cut its reimbursements by as much as 30% As a result, the clinic wants to better understand its...

Study smarter with the SolutionInn App