Suppose as in Example 17.5 that oil will be selling in April for $59.79, $61.79, or $63.79

Question:

Suppose as in Example 17.5 that oil will be selling in April for $59.79, $61.79, or $63.79 per barrel. Consider a firm that plans to buy 100,000 barrels of oil in April. Show that if the firm buys 100 oil contracts, its net expenditures will be hedged and equal to $6,179,000.

Transcribed Image Text:

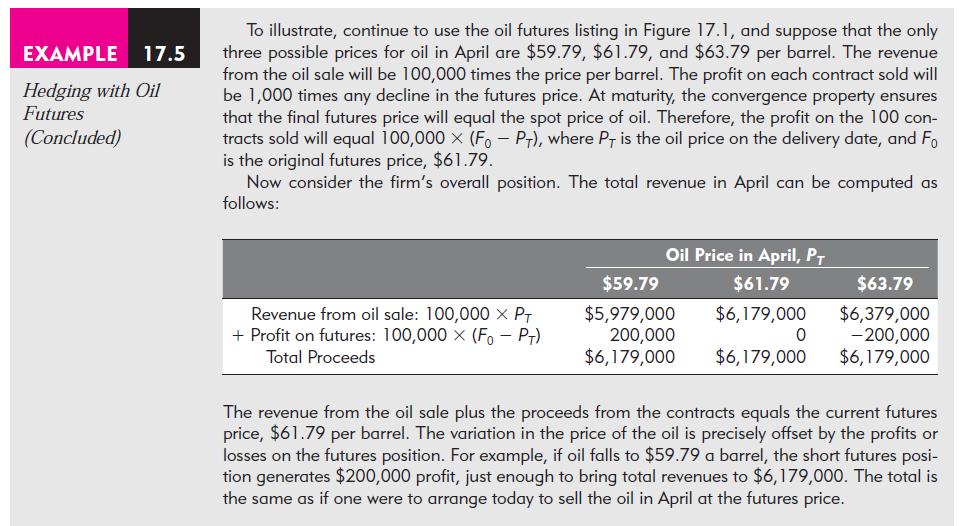

EXAMPLE 17.5 Hedging with Oil Futures (Concluded) To illustrate, continue to use the oil futures listing in Figure 17.1, and suppose that the only three possible prices for oil in April are $59.79, $61.79, and $63.79 per barrel. The revenue from the oil sale will be 100,000 times the price per barrel. The profit on each contract sold will be 1,000 times any decline in the futures price. At maturity, the convergence property ensures that the final futures price will equal the spot price of oil. Therefore, the profit on the 100 con- tracts sold will equal 100,000 × (F-PT), where PT is the oil price on the delivery date, and Fo is the original futures price, $61.79. Now consider the firm's overall position. The total revenue in April can be computed as follows: Revenue from oil sale: 100,000 X PT + Profit on futures: 100,000 X (Fo - PT) Total Proceeds Oil Price in April, PT $61.79 $6,179,000 $6,179,000 $59.79 $5,979,000 200,000 $6,179,000 0 $63.79 $6,379,000 - 200,000 $6,179,000 The revenue from the oil sale plus the proceeds from the contracts equals the current futures price, $61.79 per barrel. The variation in the price of the oil is precisely offset by the profits or losses on the futures position. For example, if oil falls to $59.79 a barrel, the short futures posi- tion generates $200,000 profit, just enough to bring total revenues to $6,179,000. The total is the same as if one were to arrange today to sell the oil in April at the futures price.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 28% (7 reviews)

Calculate the total revenue from the oil sale assuming that the oil price in April is 5979 6179 or 6...View the full answer

Answered By

Fahmin Arakkal

Tutoring and Contributing expert question and answers to teachers and students.

Primarily oversees the Heat and Mass Transfer contents presented on websites and blogs.

Responsible for Creating, Editing, Updating all contents related Chemical Engineering in

latex language

4.40+

8+ Reviews

22+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Pricing Call and Put Options: In the text we mentioned contracts called call and put options as examples of somewhat more sophisticated ways in which one can take a short or long position in the...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

Calculate the dollar proceeds from the FIs loan portfolio at the end of the year, the return on the FIs loan portfolio, and the net interest margin for the FI if the spot foreign exchange rate has...

-

What obligations does a researcher have with respect to confidentiality?

-

The function y = 0.03x2 + 245.50, 0 approximates the exhaust temperature y in degrees Fahrenheit, where x is the percent load for a diesel engine. (a) Find the inverse function. What does each...

-

A fluid flows past a sphere with an upstream velocity of \(V_{0}=40 \mathrm{~m} / \mathrm{s}\) as shown in Fig. P4.46. From a more advanced theory it is found that the speed of the fluid along the...

-

On January 1, 2016, Technicians Credit Union (TCU) issued 7%, 20-year bonds payable with face value of $100,000. The bonds pay interest on June 30 and December 31. The issue price of the bonds is...

-

Glamly uses a normal costing system and applies manufacturing overhead to jobs at a rate of 110% of direct labor costs. The company had no beginning or ending raw materials or work-in-process...

-

a. Suppose the benchmark weights had been set at 70% equity, 25% fixed-income, and 5% cash equivalents. What then would be the contributions of the managers asset allocation choices? b. Suppose the...

-

Consider the call option in Example 16.2. If it sells for $15 rather than the value of $13.70 found in the example, is its implied volatility more or less than 0.5? Use Spreadsheet 16.1 (available at...

-

A mass spectrometer similar to the one in Figure P24.67 is designed to analyze biological samples. Molecules in the sample are singly ionized, then they enter a \(0.80 \mathrm{~T}\) uniform magnetic...

-

What are emotions, and how do we experience them?

-

__________ __________ __________is the most common biological cause of intellectual disability.

-

What are the key criteria that should be applied when preparing financial statements for Islamic business organisations?

-

Provide a specific example of why a partnership may want to use a disclosed basis of accounting instead of GAAP.

-

Summer Corporation acquired a 45% interest in Winter Company on June 1, 2006, for $250,000. The controller for Summer Corporation is now preparing the first set of financial statements since the...

-

The net income for a firm is currently $1,000,000 and is projected to grow annually for the next four years as follows: $1,200,000, $1,300,000, $1,500,000, and $1,700,000. Assuming the dividend...

-

For the vector whose polar components are (Vr = 1, Vθ = 0), compute in polars all components of the second covariant derivative Vα;μ;ν. To find...

-

Consider two mutually exclusive alternatives stated in year-O dollars. Both alternatives have a 3-year life with no salvage value . Assume the annual inflation rate is 5%, an income tax rate of 25%,...

-

Examine the financial pages of your newspaper (or the Wall St. Journal) and determine the current interest rate on the following securities, and explain why the interest rates are different for these...

-

Consider four mutually exclusive alternatives: Each alternative has a 10-year usefu11ife and no salvage value . Over what range of interest rates is C the preferred alternative A B Initial cost $100...

-

After reading "Three Social Security Fixes to Solve the Real Fiscal Crisis" post responses to the following questions/prompts: What are the concerns about social security and spending deficits in...

-

State what measures you have taken to mitigate the negative effects of engineering activities.

-

0.10 Compile a simple WBS for the project that you are working on. Discuss your WBS with your project manager and incorporate his/her feedback to your answer. (20) 0.11 Compile a simple schedule for...

Study smarter with the SolutionInn App