What will be the rate of return in Example 11.5 if the manager forecasts that in two

Question:

What will be the rate of return in Example 11.5 if the manager forecasts that in two years the yield to maturity on 18-year maturity bonds will be 10% and that the reinvestment rate for coupons will be 8%?

Transcribed Image Text:

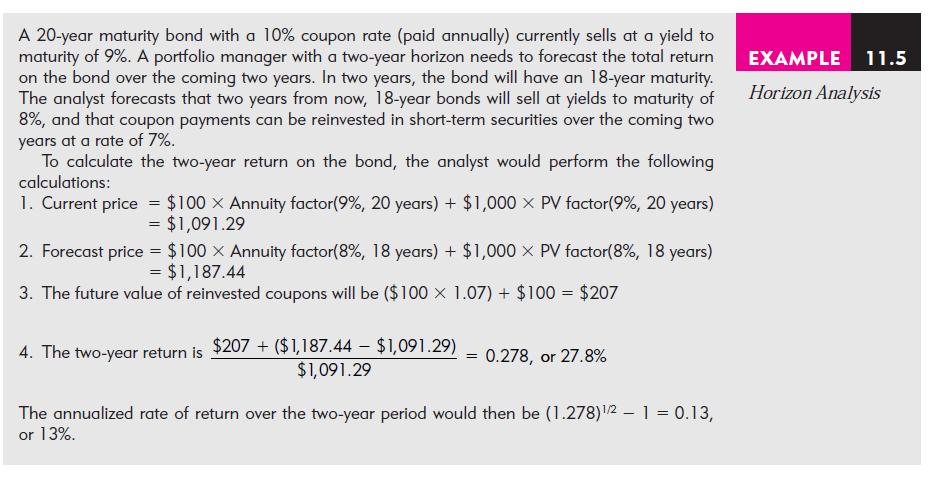

A 20-year maturity bond with a 10% coupon rate (paid annually) currently sells at a yield to maturity of 9%. A portfolio manager with a two-year horizon needs to forecast the total return on the bond over the coming two years. In two years, the bond will have an 18-year maturity. The analyst forecasts that two years from now, 18-year bonds will sell at yields to maturity of 8%, and that coupon payments can be reinvested in short-term securities over the coming two years at a rate of 7%. To calculate the two-year return on the bond, the analyst would perform the following calculations: 1. Current price = $100 x Annuity factor (9%, 20 years) + $1,000 x PV factor(9%, 20 years) = $1,091.29 2. Forecast price = $100 × Annuity factor(8%, 18 years) + $1,000 x PV factor(8%, 18 years) = $1,187.44 3. The future value of reinvested coupons will be ($100 x 1.07) + $100 = $207 4. The two-year return is $207 + ($1,187.44 - $1,091.29) $1,091.29 = 0.278, or 27.8% The annualized rate of return over the two-year period would then be (1.278)¹/2 - 1 = 0.13, or 13%. EXAMPLE 11.5 Horizon Analysis

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Current price 109129 Forecast price 100 Annuity factor 10 18 ye...View the full answer

Answered By

Hassan Ali

I am an electrical engineer with Master in Management (Engineering). I have been teaching for more than 10years and still helping a a lot of students online and in person. In addition to that, I not only have theoretical experience but also have practical experience by working on different managerial positions in different companies. Now I am running my own company successfully which I launched in 2019. I can provide complete guidance in the following fields. System engineering management, research and lab reports, power transmission, utilisation and distribution, generators and motors, organizational behaviour, essay writing, general management, digital system design, control system, business and leadership.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

A 20-year maturity bond with a 10% coupon rate (paid annually) currently sells at a yield to maturity of 9%. A portfolio manager with a 2-year horizon needs to forecast the total return on the bond...

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Thinking Tools Services assembles customized personal computers from generic parts. Formed and operated by part-time SVCI students Paulette Cruz and Maureen Luis, the company has had steady growth...

-

Name some common objectives of cross-sectional surveys.

-

A cab was involved in a hit-and-run accident at night. Two cab companies green and blue operate 85% and 15% of the cabs in the city respectively. A witness identified the cab as blue. However, in a...

-

You have made a review and preliminary evaluation of the Morgan Company's system of internal conirol, and based on this, you have designed a tentative audit program. Your next step is to perform...

-

Tennessee just instituted a state lottery. The initial jackpot is $100,000. If the first week yields no winners, the next weeks jackpot goes up, depending on the number of previous players who placed...

-

A barbell spins around a pivot at its center at A. The barbell consists of two small balls, each with mass 400 grams (0.4 kg), at the ends of a very low mass rod of length d = 25 cm (0.25 m; the...

-

How would an increase in trading costs affect the attractiveness of dedication versus immunization?

-

a. Suppose that this pension fund is obligated to pay out $800,000 per year in perpetuity. What should be the maturity and face value of the zero-coupon bond it purchases to immunize its obligation?...

-

How do banks make profit and what considerations must banks give to the trade-off between security and profit?

-

If the risk-free rate is 5 percent and corporate bonds are trading at 8.2 percent and the recovery rate on default loans is 55%, what is the risk premium on a bond of $1,950,000.00 if statistics show...

-

HOW TO Analyze TESLA'S business performance using the financial statements, AND Give investors (audience) suggestions on whether to buy, sell, hold the stocks for the next 12 months? .

-

How do international money, credit, bond and stock markets differ from one another?

-

Joey Chestnut, the hot dog competitive eating champion, sees all of these ads for home workout machines. He is disappointed because his gyms - restaurants - aren't open so he cannot work out. Thus,...

-

Blue Ocean Industries has purchased a machine one year ago at the cost of 12000. At the time of purchase the estimated life of the machine was 6 years with no salvage value. The annual cash operating...

-

After a series of extensive meetings, several of the key decision makers for a small marketing firm have produced the following payoff table (expected profit per customer) for various advertising...

-

A fast-food restaurant averages 150 customers per hour. The average processing time per customer is 90 seconds. a. Determine how many cash registers the restaurant should have if it wishes to...

-

Suppose that short-term municipal bonds currently offer yields of 4%, while comparable taxable bonds pay 5%. Which gives you the higher after-tax yield if your tax bracket is: a. Zero b. 10% c. 20%...

-

Suppose that short-term municipal bonds currently offer yields of 4%, while comparable taxable bonds pay 5%. Which gives you the higher after-tax yield if your tax bracket is: a. Zero b. 10% c. 20%...

-

Why do most professionals consider the Wilshire 5000 a better index of the performance of the broad stock market than the Dow Jones Industrial Average?

-

Flexible Budget for Various Levels of Production Budgeted amounts for the year: Materials Labor VOH FOH 2 leather strips @ $7.00 1.5 hr. @ $18.00 1.5 hr. @ $1.20 $6,800 Required: 1. Prepare a...

-

If total energy absorbed must equal total energy released, how is it possible for an atom to absorb visible light and release heat? Explain.

-

The purpose of one-way ANOVA is to compare multiple means from the variations of the mean. The null hypothesis is Ho = 2 = = k and alternate is HA i Hj. We have the sample data in the table: Y1 Y2...

Study smarter with the SolutionInn App