You have the following information for IBX Corporation for the years 2006 and 2009 (all figures are

Question:

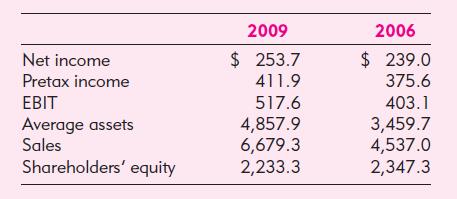

You have the following information for IBX Corporation for the years 2006 and 2009 (all figures are in $millions):

What is the trend in IBX’s ROE, and how can you account for it in terms of tax burden, margin, turnover, and financial leverage?

Transcribed Image Text:

Net income Pretax income EBIT Average assets Sales Shareholders' equity 2009 $ 253.7 411.9 517.6 4,857.9 6,679.3 2,233.3 2006 $ 239.0 375.6 403.1 3,459.7 4,537.0 2,347.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

To analyze the trend in IBX Corporations Return on Equity ROE from 2006 to 2009 we can break down the ROE into its component parts ROE Net Income Shar...View the full answer

Answered By

Mary Njunu

I posses Vast, diversified knowledge and excellent grammar as a result of working in ACADEMIC WRITING for more than 5 years. I deliver work in various disciplines with assurance of quality work. I purpose at meeting the clients’ expectations precisely. Let’s work together for the best and phenomenal grades.

4.90+

928+ Reviews

2551+ Question Solved

Related Book For

Essentials Of Investments

ISBN: 9780073368719

7th Edition

Authors: Zvi Bodie, Alex Kane, Alan J. Marcus

Question Posted:

Students also viewed these Business questions

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Ques 1: What is the major complaint by firms concerning the Sarbanes-Oxley act of 2012? A. the legislative maximum allowable compensation for a CEO. B. the legal requirement to disclose project...

-

What impact do attitudes have on consumer behavior?

-

Not sure if this note is applicable to the problem? (A2) Prove there is a bijection between any two countably infinite sets.

-

Comment on the following situation: A product manager asks the research department to forecast costs for some basic ingredients (raw materials) for a new product. The researcher asserts that this is...

-

In Exercises 1-4, find a polynomial of degree n that has the given zero(s). (There are many correct answers.) Zero(s) Degree 1. x = - 3 n = 2 2. x = - 2, 2 n = 2 3. x = 5, 0, 1 n = 3 4.x = 2, 6 n = 3

-

As is indicated in Fig. P4.42, the speed of exhaust in a car's exhaust pipe varies in time and distance because of the periodic nature of the engine's operation and the damping effect with distance...

-

Oakenfeld Company manufactures a number of specialized machine parts. PartBunkka-22 uses $35 of direct materials and $15 of direct labor per unit.Oakenfeld??s estimated manufacturing overhead is as...

-

At January 1, 2024, Caf Med leased restaurant equipment from Crescent Corporation under a nine-year lease agreement. The lease agreement specifies annual payments of $31,000 beginning January 1,...

-

Graph the payoff diagram for the collar described in Example 15.5. EXAMPLE 15.5 Collars A collar would be appropriate for an investor who has a target wealth goal in mind but is unwilling to risk...

-

What were GIs ROE, P/E, and P/B ratios in the year 2008? How do they compare to the industry average ratios, which were: How does GIs earnings yield in 2008 compare to the industry average? ROE =...

-

A manufacturing manager uses a dexterity test on 20 current employees in order to predict watch production based on time to completion (in seconds). A portion of the data is shown below. Time...

-

How would the aggression of the Boston Marathon bombers be interpreted by the three main approaches to the study of aggression: instinct approaches, frustration- aggression approaches, and...

-

If a dangerously violent person could be cured of violence through a new psychosurgical technique, would you approve the use of this technique? Suppose the person agreed toor requestedthe technique?...

-

What are the three bases of accounting for a private corporation?

-

Using Figure 14.12 (Problem 6), what is the maximum difference in change in payout between benefit programs (as compared to a year ago)? Data from Problem 6 Consider the graph shown in Figure 14.12....

-

When would the use of GAAP not be appropriate?

-

General Manufacturing Company (GMC) follows a policy of paying out 50% of its net income as cash dividends to its shareholders each year. The company plans to do so again this year, during which GMC...

-

On average there are four traffic accidents in a city during one hour of rush-hour traffic. Use the Poisson distribution to calculate the probability that in one such hour there arc (a) No accidents...

-

Suppose Baa-rated bonds currently yield 7%, while Aa-rated bonds yield 5%. Now suppose that due to an increase in the expected inflation rate, the yields on both bonds increase by 1%. a. What would...

-

Suppose Baa-rated bonds currently yield 7%, while Aa-rated bonds yield 5%. Now suppose that due to an increase in the expected inflation rate, the yields on both bonds increase by 1%. a. What would...

-

Using the following data on bond yields, calculate the change in the confidence index from last year to this year. What besides a change in confidence might explain the pattern of yield changes?...

-

The political party that challenged briefly united Black and white sharecroppers in the late nineteenth century South was called what?

-

Justify how feedback will help you develop as a Next - Gen candidate in all individuals can learn.

-

Explain the significance of the New York School of Art in the 1 9 5 0 'sin America. Name at least 1 0 painters that were a part of this group.

Study smarter with the SolutionInn App