Question: Rework Example 16.1 for a $15,000 loan at a 10% annual interest. Example 16.1 You wish to borrow $100,000 for 10 years at 5.0 percent

Rework Example 16.1 for a $15,000 loan at a 10% annual interest.

Example 16.1

You wish to borrow $100,000 for 10 years at 5.0 percent annual interest. What is the difference in the cost of the loan if it is compounded yearly, monthly, or daily?

Need: Cost of borrowing $100,000 for 10 years at 5.0 percent under assumptions of 10 annual payment periods, 120 monthly periods, and 3,650 daily periods.

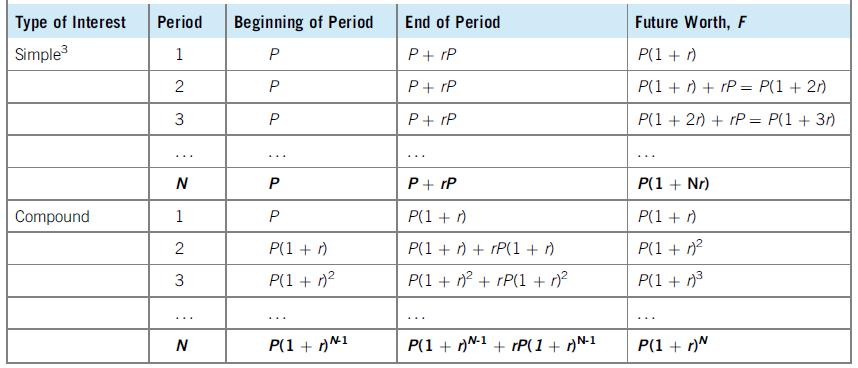

Know–How: The formulae for compound interest from Table 16.1 is F = P(1 + r)N

Table 16.1

Type of Interest Period Beginning of Period End of Period Future Worth, F Simple 1 P+ rP P(1 +) 2 P+ rP P(1 + ) + rP = P(1 + 2) P+ rP P(1 + 2r) + rP = P(1 + 3r) ... ... ... ... P+ rP P(1 + Nr) Compound 1 P P(1 +) P(1 +) 2 P(1 + ) P(1 + ) + rP(1 + ) P(1 + n2 P(1 + n2 P(1 + n? + rP(1 + n? P(1 + n3 ... ... N-1 N P(1 + n P(1 + N-1 + rP(1+ nN1 P(1 + r)N

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

The formula for compound interest is F P1 rN where F is the final amount P is the princip... View full answer

Get step-by-step solutions from verified subject matter experts