Bill decided to incorporate his printing business and to give his manager, Charlie, a share in the

Question:

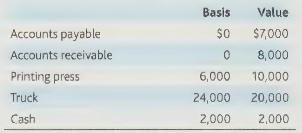

Bill decided to incorporate his printing business and to give his manager, Charlie, a share in the business. Bill's sole proprietorship transferred the following to Tom Co.:

Bill received 70 shares of the stock, worth \(\$ 29,000\). Charlie invested \(\$ 2,000\) in cash and received the remaining 30 shares of the stock.

What are the tax consequences to Bill, Charlie, and Tom Co.?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: