Consider the facts in problem 57 above. Assume the partnership does not have a Section 754 election

Question:

Consider the facts in problem 57 above. Assume the partnership does not have a Section 754 election in effect, and decides not to make one. Shortly after the new buyer's acquisition of Jack's interest in the partnership, the partnership sells property 1 for its \(\$ 51,000\) fair market value.

a. How much gain will the partnership recognize on the sale, and how much of this gain will be allocated to the new partner for tax purposes?

b. If the partnership did have a Section 754 election in effect, how much gain would be allocated to the new partner in connection with the partnership's sale of property 1 ?

c. Assume the partnership had a Section 754 election in effect when the new partner acquired Jack's fifty percent partnership interest. Assume that the partnership later sold property 1 for \(\$ 69,000\) (it appreciated in value after the new partner's entry). How much gain would the partnership recognize for tax purposes, and how much of this gain would be allocated to the new partner?

Problem 57

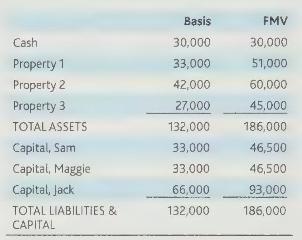

Bust-out Partners had the following balance sheets at year-end:

On December 31, Jack sold his fifty percent interest in the partnership to an unrelated buyer for \(\$ 93,000\). None of the partnership's properties constitute inventory or unrealized receivables.

a. How much gain must Jack recognize on the sale?

b. What will be the buyer's tax basis in the newly acquired partnership interest?

c. Assume the partnership has a Section 754 election in effect. Determine the amount of the partnership's basis adjustment under Section 743(b), and allocate the adjustment among the partnership's assets

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback