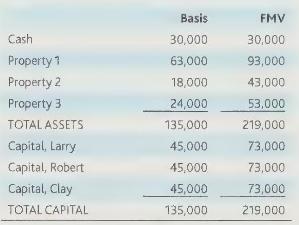

RT Ranches is a general partnership with the following balance sheets: On December 31, in complete liquidation

Question:

RT Ranches is a general partnership with the following balance sheets:

On December 31, in complete liquidation of his interest, the partnership distributed property 2 and \(\$ 30,000\) cash to Clay. None of the partnership's properties constitute inventory or unrealized receivables.

a. How much gain will Clay recognize in connection with the distribution?

b. Assume the partnership did not have a Section 754 election in effect and chose not to make one. Compare the amount of taxable gain which will be reported by Larry and Robert if the partnership sells properties 1 and 3 after Clay's departure to the amount of gain they would have recognized had the partnership sold all three of its properties just prior to Clay's departure from the partnership.

c. What explains the difference you identify in part \(b\) above? Is there a remedy available to Larry and Robert?

Step by Step Answer:

CCH Federal Taxation 2019 Comprehensive Topics

ISBN: 9780808049081

2019 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback