During the following years Adolpho T. (single) had (1) withheld, (2) paid (by check presumably estimated

Question:

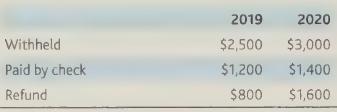

During the following years Adolpho T. (single) had (1) withheld, (2) paid (by check — presumably estimated tax payments or paid with the extension) and (3) received a refund of the following amounts for state income tax purposes:

The refunds were all of amounts “paid”

(withheld and paid by check) in the prior year. Adolpho’s total itemized deductions in 2019 were $14,400. What is Adolpho’s state income tax deduction for each year, and his income from the refund in 2020? What would his income from the 2020 refund be if the refund was $2,400, rather than $1,600?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: