Howard Hayes was killed in a freak barbecuing accident at a local eatery called P.K.s Barbecue Shack

Question:

Howard Hayes was killed in a freak barbecuing accident at a local eatery called P.K.’s Barbecue Shack on October 28, 2017, in Wilson, North Carolina. He was survived by his wife, Helen (age 56), and two children, Isaac (34) and Heidi (32).

Howard’s will provided that Helen would receive one half of the residuary estate and the balance of the residue would be divided equally between the children. The will provided that any direct obligations be paid out of the principal of the residuary estate.

The post-mortem tax plan instituted by the executor requires payment of commissions in the year of termination of the estate (no deductions for commissions on this return).

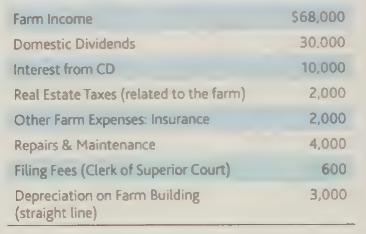

All expenses are first allocable to farm income and, if farm income is exhausted, then to other ordinary income. Unattached or floating deductions will all be allocated against income on a pro rata basis. At the time of Mr. Hayes’ death, he owned a small farm. In 2018, fertilizer expenses totaled $5,000, seed costs were $2,500, and proceeds from the sale of crops were $68,000.

At the time of his death, Howard wanted $10,000 to be paid out of estate income to East Carolina University. The executor, after ascertaining the status of this obligation, paid the pledge on December 10, 2018.

The executor elected to report income on a calendar-year basis. The following information pertains to 2018 income:

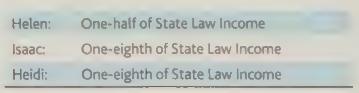

The executor was instructed via the will to distribute income during the period of administration as follows:

Reidsville Bank & Trust Co., N.A., was named executor of Howard Hayes’ estate and their trust department is responsible for preparing all of the 1041 returns. The address is 1454 Scales Street, Reidsville, NC 27390. The estate's identification number is 56-1053613; the return is filed on April 5, 2019; and the officer signing the return is Tom Phillips.

The following items are required:

(1) State Law Income under Code Sec. 643(b)

(2) DNI as an income ceiling (3) DNI as a deduction ceiling (4) Estate’s taxable income (5) DNI as a qualitative yard stick (6) K-1 allocations (7) U.S. Fiduciary Income Tax Return (Form 1041)

(8) Form 4562 (9) Schedule F (10) Schedule K-1 for Helen Hayes (11)Schedule K-1 for Isaac Hayes (12)Schedule K-1 for Heidi Hayes

Step by Step Answer:

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback