Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

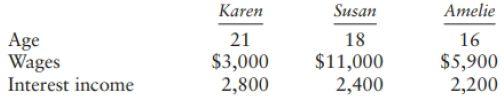

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2018. Mike and Linda provided $8,000 of support for each child. Information for each child is as follows:

Compute each child's tax, assuming the interest income is taxable.

Transcribed Image Text:

Karen Amelie Susan 18 Age Wages Interest income 21 16 $3,000 2,800 $11,000 2,400 $5,900| 2,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (10 reviews)

Karen Karens gross tax is 245 At age 21 Karen is subject to the kiddie tax because she is a fulltime ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax table 3.5. Assume that their taxable income this year was $309,000. Round your...

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

MVP Company issued a callable bond. The bond is a 7% semiannual coupon bond currently priced at 102 that has a remaining time to maturity of seven years. The bond is callable beginning the end of...

-

Shot that the product of a rational number (other than 0) and an irrational number is irrational.

-

Show that Q under addition is not a free abelian group.

-

Draw a cash flow diagram of any investment that exhibits both of the following properties: 1. The investment has a 4-year life. 2. The investment has a 10 percent/year internal rate of return.

-

Perform analytical procedures for accounts payable of J & J Auto Repair Service in the following manner: a. Calculate and list all necessary figures and comparisons. b. Explain what the result of...

-

Consider a web system for online shopping that will generate an ID for each order. The order ID is a sequence of 7 characters where each char- acter could be either one of the 26 upper case English...

-

Tri- State Manufacturing has three factories (1, 2, and 3) and three warehouses (A, B, and C). The following table shows the shipping costs between each factory and warehouse, the factory...

-

Jan, a single taxpayer, has adjusted gross income of $250,000, medical expenses of $10,000, home mortgage interest of $3,000, and property taxes of $2,000. Should she itemize or claim the standard...

-

In 2018, Lana, a single taxpayer with AGI of $204,400, claims three dependent children, all under age 17. What is the amount of her child credit?

-

Why do measures that claim to assess the same construct sometimes appear so vastly different from one another?

-

Identify three risks , then describe mitigation measures you would take to prevent each risk from occurring (or lessening their impact). Use at least 200 words for each risk. Risk 1 [Insert Name of...

-

WyCo s fiscal year ends September 3 0 . On September 1 0 , it collects $ 3 0 , 0 0 0 for a painting job and credits Unearned Painting Revenue. As of September 3 0 , 6 0 % of the work has been done....

-

The potential macroeconomic benefits of generative artificial intelligence and machine-learning technologies are staggering, on par with transformative technologies that fed the industrial revolution...

-

BUSI 411 Extra Credit Assignment Options Instructions: Create a Word document and answer the following questions following APA formatting guidelines. Question 1 (a) Explain the term Option Greeks (b)...

-

Background: BrightFoods Inc. is a growing food distribution company that has decided to modernize its operations by implementing a new Information System (IS). The company aims to improve its...

-

Polychlorinated biphenyls (PCBs), industrial pollutants, are known to be carcinogens and a great danger to natural ecosystems. As a result of several studies, PCB production was banned in the United...

-

Assume Eq. 6-14 gives the drag force on a pilot plus ejection seat just after they are ejected from a plane traveling horizontally at 1300 km/h. Assume also that the mass of the seat is equal to the...

-

Howard Gartman is a 40% partner in the Horton & Gartman Partnership. During 2015, the partnership reported the total items below (100%) on its Form 1065: Ordinary income .. $180,000 Qualified...

-

In 2014, Paul, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not...

-

Which of the following individuals is most likely to be audited? a. Connie has a $20,000 net loss from her unincorporated business (a cattle ranch). She also received a $200,000 salary as an...

-

List any four sauces that are most commonly preferred to serve with vegan dishes. Also provide the list of main ingredients used for preparing the sauce.

-

explain how asset impairment may be used for earnings manipulation?

-

Discuss how an information system's architecture planning contributes to overall enterprise risk in the organizations. Research & share the reference(s) for the following elements for a specific...

Study smarter with the SolutionInn App