Question: BUSI 411 Extra Credit Assignment Options Instructions: Create a Word document and answer the following questions following APA formatting guidelines. Question 1 (a) Explain

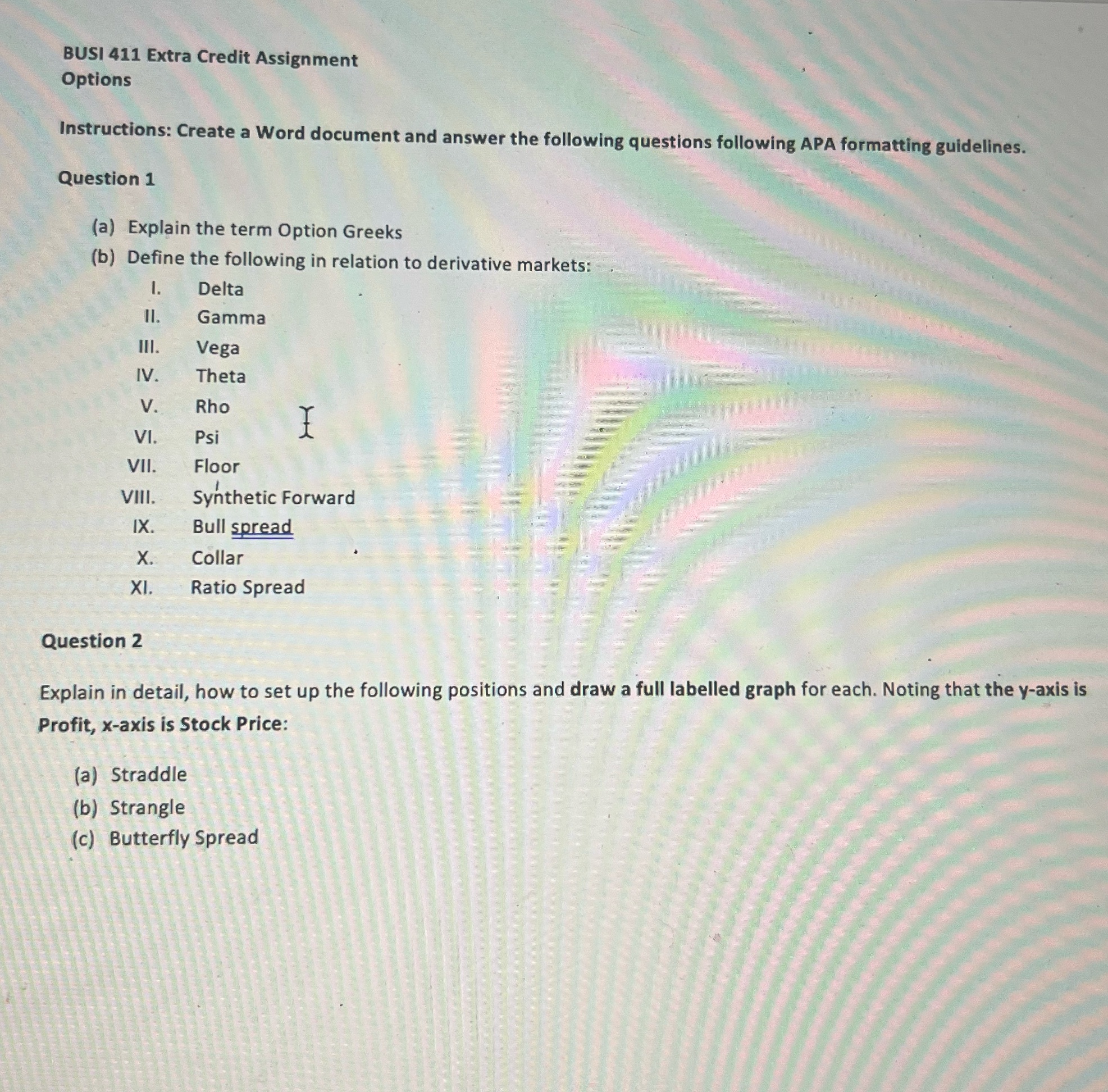

BUSI 411 Extra Credit Assignment Options Instructions: Create a Word document and answer the following questions following APA formatting guidelines. Question 1 (a) Explain the term Option Greeks (b) Define the following in relation to derivative markets: 1. Delta II. Gamma III. Vega IV. Theta V. Rho VI. Psi VII. Floor VIII. Synthetic Forward IX. Bull spread X. Collar Ratio Spread XI. Question 2 Explain in detail, how to set up the following positions and draw a full labelled graph for each. Noting that the y-axis is Profit, x-axis is Stock Price: (a) Straddle (b) Strangle (c) Butterfly Spread

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

1 a Option Greeks Option Greeks are a set of risk measures used in options trading to assess the sensitivity of an options price to various factors such as changes in the underlying asset price time d... View full answer

Get step-by-step solutions from verified subject matter experts