Refer to the facts in Problem 22 but assume that Al's total car expenses amounted to only

Question:

Refer to the facts in Problem 22 but assume that Al's total car expenses amounted to only $4,700. What is the amount of Al's car expense deduction on his current year tax return?

Problem 22

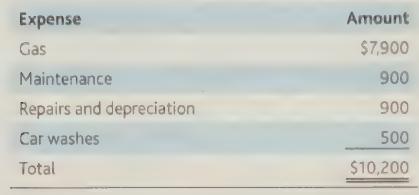

For the current year, Al Johnson used his personal car for both business and personal purposes. He drove 18,000 miles in the car during the year: 10,000 miles were for business-related purposes and 8,000 miles were for personal purposes. He incurred the following car expenses during the year:

Based on this information, what part of the above car expenses is deductible as business- related expenses on Al's current year income tax return?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: