Robert Reed, a bachelor, maintains his parents in a nursing home. They have no income of their

Question:

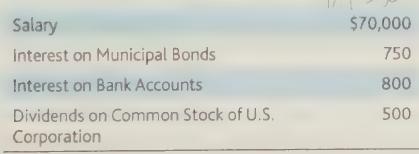

Robert Reed, a bachelor, maintains his parents in a nursing home. They have no income of their own and are completely dependent on their son. His parents are 75 and 72 years of age. Robert has the following sources of income:

Robert has itemized deductions of $19,000. Robert owns several apartment buildings. His net rental income was $3,000 for the year. Then, on December 31 one of his best tenants brought in a check for $500. This money covers the months of December and January. Robert is confused on how to account for this rental income. It is not included in the $3,000 listed above. Compute Robert's taxable income.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

CCH Federal Taxation Basic Principles 2020

ISBN: 9780808051787

2020 Edition

Authors: Ephraim P. Smith, Philip J. Harmelink, James R. Hasselback

Question Posted: