The financial accounting balance sheet for Zane, a retail sales corporation, as of the end of the

Question:

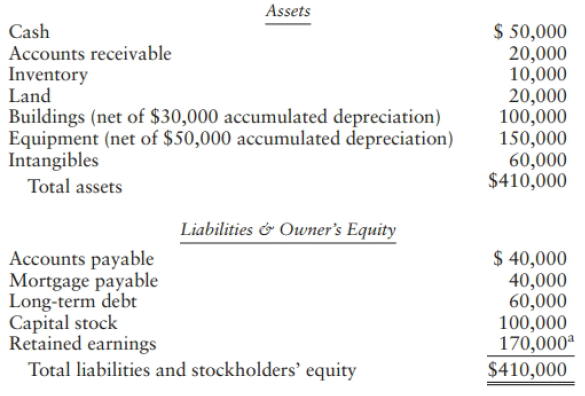

The financial accounting balance sheet for Zane, a retail sales corporation, as of the end of the current year is as follows:

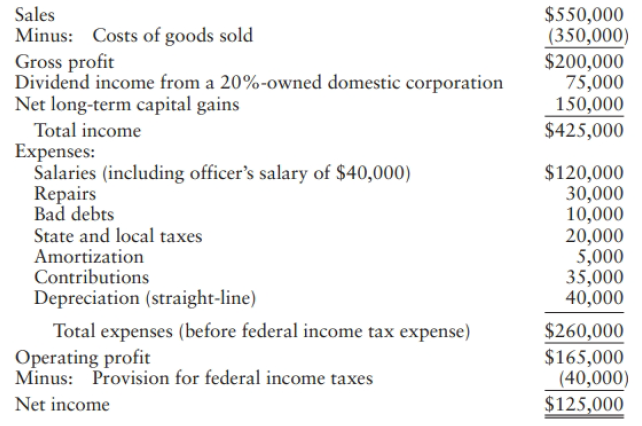

Using the accrual method Zane reports the following financial accounting operating re-suits for the cur rent year:

All dividends qualify for the dividends-received deduction. In addition, the following items should be taken into account:Current-year estimated tax payments ............................... $15,000MACRS depreciation for tax purposes ................................. 60,000Prepare a current year Form 1120 (U.S. Corporation Income Tax Return) for Zane. Disregard beginning-of-the-year balance sheet amounts other than retained earnings. Also, leave spaces blank on Form 1120 for information not provided.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Federal Taxation 2019 Individuals

ISBN: 9780134739670

32nd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson