L and M form the LM Partnership with equal cash contributions of $300,000. The partnership then borrows

Question:

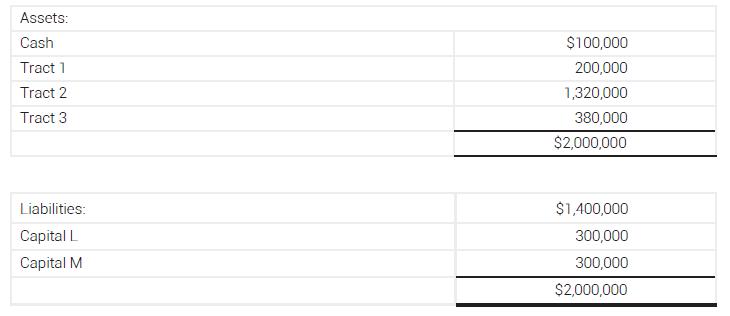

L and M form the LM Partnership with equal cash contributions of $300,000. The partnership then borrows $1,400,000 and purchases several tracts of land at a total cost of $1,900,000. Immediately after the acquisition, the partnership’s Section 704(b) balance sheet appears as follows:

Tract 1 is subsequently distributed to L in a nonliquidating distribution. If Tract 1 is valued at $320,000 at the date of distribution, what will L’s Section 704(b) capital account be after the distribution, assuming no other assets are revalued?

a. $100,000.

b. $40,000.

c. $20,000.

d. $0.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Taxation Essentials Of LLCs And Partnerships

ISBN: 9781119722328

1st Edition

Authors: Larry Tunnell, Robert Ricketts

Question Posted: