P and S Corporations form in Year 1, with S as Ps wholly-owned subsidiary. The corporations immediately

Question:

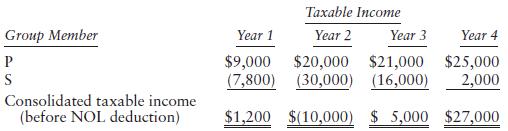

P and S Corporations form in Year 1, with S as P’s wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results:

In what year(s) can the group deduct the Year 2 consolidated NOL? Assume that Year 2 is a post-2017 year.

Transcribed Image Text:

Taxable Income Group Member Year 1 Year 2 Year 3 Year 4 $9,000 $20,000 $21,000 $25,000 (7,800) (30,000) (16,000) P S 2,000 Consolidated taxable income (before NOL deduction) $1,200 $(10,000) $ 5,000 $27,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (6 reviews)

4000 in Year 3 and 6000 in Year 4 Because the NOL arose in a pos...View the full answer

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

P and S Corporations form in Year 1, with S as Ps wholly-owned subsidiary. The corporations immediately elect to file consolidated tax returns. The group reports the following results: The group does...

-

P and S Corporations have filed consolidated tax returns for ten years. P and S use the accrual method of accounting, and they use the calendar year as their tax year. P and S report separate return...

-

P and S Corporations have filed consolidated tax returns for several years. In Year 1, P purchased land as an investment for $20,000. In Year 3, P sold the land to S for $60,000. S used the land for...

-

World Information Group has two major divisions: print and Internet. Summary financial data (in millions) for 2011 and 2012 are: The annual bonuses of the two division managers are based on division...

-

You have just been hired by General Motors to tour Canada giving randomly selected drivers test rides in a new Corvette (yeah, right). After giving the test drive, you must ask the rider whether he...

-

a. Wise Photography reported net income of $130,000 for 2020. Included in the income statement were depreciation expense of $6,000, amortization expense of $2,000, and a gain on disposal of equipment...

-

Water flows over the sharp-crested weir shown in Fig. P10.86. The weir plate cross section consists of a semicircle and a rectangle. Plot a graph of the estimated flowrate, \(Q\), as a function of...

-

Multiple Choice Questions 1. As a golf club production company produces more clubs, the average total cost of each club produced decreases. This is because: a. Total fixed costs are decreasing as...

-

In the context of heat exchangers, how does the design and optimization of finned surfaces influence overall heat transfer performance, particularly in high-temperature applications like gas turbine...

-

1. Justify Jinhee's participation in her employer's 401 (k) plan using the time value of money concepts. 2. Calculate the amount that Jinhee needs to save each year for the down payment on a new car,...

-

P Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 2, P sells...

-

Peoria and Salem Corporations have filed consolidated tax returns for several years. For the current year, consolidated taxable income is $300,000. The consolidated general business credit (computed...

-

While traveling in the far north, one of y our companions gets snow blindness, and you have to lead him along by the elbow. Looking back, you see your other companion, Sandy, fall and slide along the...

-

Tabular data are often saved in the CSV (comma-separated values) format. Each table row is stored in a line, and column entries are separated by commas. However, if an entry contains a comma or...

-

Using backtracking, write a program that solves summation puzzles in which each letter should be replaced by a digit, such as send + more = money Your program should find the solution 9567 + 1085 =...

-

Repeat Exercise R2.16, but now declare object variables that are initialized with the required objects. Data from Exercise R2.16 Give Java code for objects with the following descriptions: a. A...

-

Support computing sales tax in the CashRegister class. The tax rate should be supplied when constructing a CashRegister object. Add recordTaxablePurchase and getTotal- Tax methods. (Amounts added...

-

Explain the difference between an object and an object variable.

-

Conan Logging and Lumber Company, a small private company that follows ASPE, owns 3,000 hectares of timberland on the north side of Mount Leno, which was purchased in 2005 at a cost of $550 per...

-

Prove that if Σ an is absolutely convergent, then a. an

-

John and Kathy Brown have just been audited and the IRS agent disallowed the business loss they claimed in 2016. The agent asserted that the activity was a hobby, nor a business. John and Kathy live...

-

Kelly is self-employed and incurs $2,200 of business meal expense in connection in with business travel. $500 of the business meal cost are considered to be lavish or extravagant. How much can Kelly...

-

Latoya is an independent contractor and operates her own successful consulting business in Milwaukee. She has just signed a large contract with a new client that will require her to spend nine months...

-

A couple obtained a $20,000 mortgage loan at an interest rate of 10.5% compounded monthly. (Original principal equals to PV of all payments discounted at the interest rate on the loan contract) (1)...

-

What strategies and tactics are employed to manage strategic risks and uncertainties, including geopolitical instability, supply chain disruptions, and emerging competitive threats, while preserving...

-

How do strategic planners integrate ethical considerations and sustainability imperatives into strategic planning processes, balancing short-term financial objectives with long-term societal and...

Study smarter with the SolutionInn App