P Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax

Question:

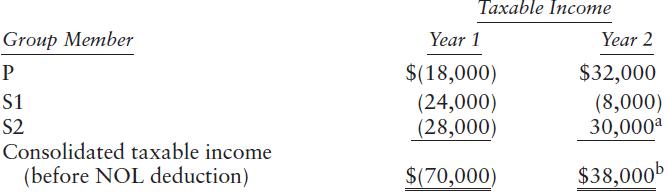

P Corporation owns all the stock of S1 and S2 Corporations. The corporations have filed consolidated tax returns since their creation in Year 1. At the close of business on July 10 of Year 2, P sells all of its S2 stock. The group reports the following results:

a $14,000 is attributable to January 1 through July 10 of Year 2, and $16,000 is attributable to July 11 through December 31 of Year 2.

b $32,000 + ($8,000) + $14,000 In what year(s) can the corporations deduct the Year 1 consolidated NOL? Assume that Year 1 is a post-2017 year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: