P Corporation acquires all of S Corporations stock at the close of business on December 31 of

Question:

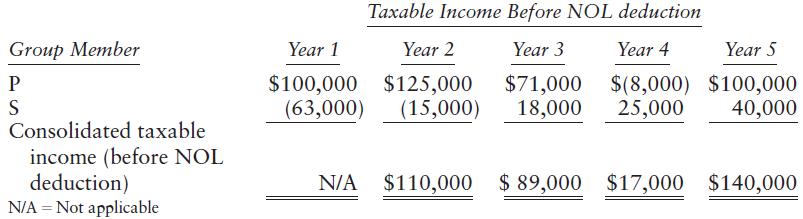

P Corporation acquires all of S Corporation’s stock at the close of business on December 31 of Year 1. The corporations, which file on the calendar year, begin filing a consolidated tax return for Year 2. The corporations report the following taxable incomes (losses), before any NOL deduction, for Years 1 through 5:

P and S have no NOLs before Year 1. Ignore the Sec. 382 loss limitation that might apply to P’s acquisition of S, assume that the acquisition does not qualify as a reverse acquisition, and assume that Year 1 is a post-2017 year. What is consolidated taxable income for each of Years 2 through 5?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: