P Corporation owns all the stock of S1 and S2 Corporations, and the group has filed consolidated

Question:

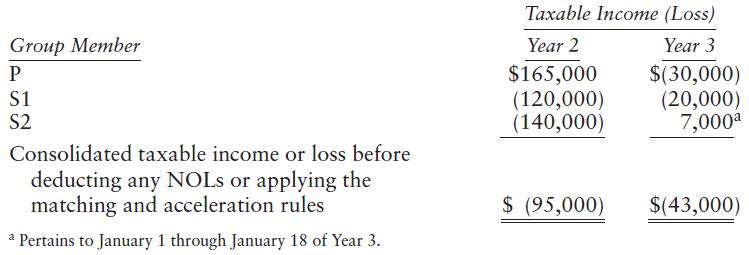

P Corporation owns all the stock of S1 and S2 Corporations, and the group has filed consolidated tax returns on a calendar year basis for several years. In the current year (Year 1), S2 sells to S1 for $90,000 land S2 had purchased for $75,000. On December 31 of Year 2, S1 sells the land to a third party for $91,000. On January 18 of Year 3, P sells all of its S2 stock to a third party for a sales price equal to P’s basis in the S2 stock. The consolidated group members report the following amounts of taxable income and loss (before deducting any NOLs or applying the matching and acceleration rules):

Assume that Year 2 is a post-2017 year.

a. Determine the amount of NOL available for S2’s Year 3 separate tax return.

b. Assume the same facts as in Part a except S1’s land sale to a third party for $91,000 occurred on January 1 of Year 3. Determine the amount of NOL available for S2’s Year 3 separate tax return.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse