Refer to Problem C:13-45. What is the net addition to Joys taxable estate attributable to the insurance

Question:

Refer to Problem C:13-45. What is the net addition to Joy’s taxable estate attributable to the insurance policies, including marital deduction implications?

Data From C:13-45:

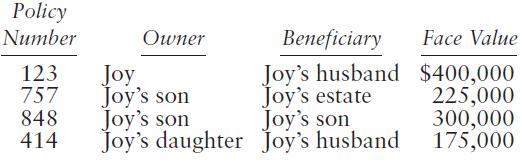

Joy died on November 5, 2020. Soon after Joy’s death, the executor discovered the following insurance policies on Joy’s life.

Joy transferred ownership of policies 757 and 848 to her son in 2010. She gave ownership of policy 414 to her daughter in 2018. Indicate the amount includible in Joy’s gross estate for each policy, without any consideration to the marital deduction.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted: