The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor mens clothing.

Question:

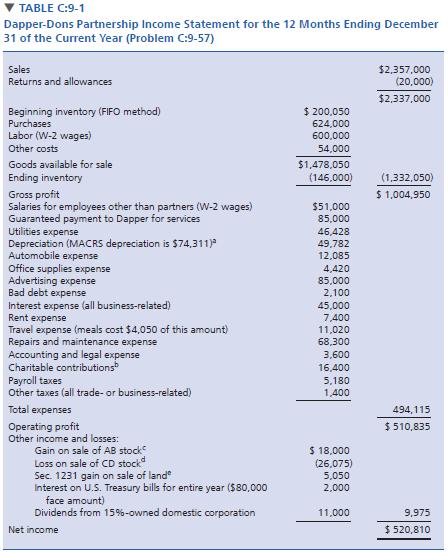

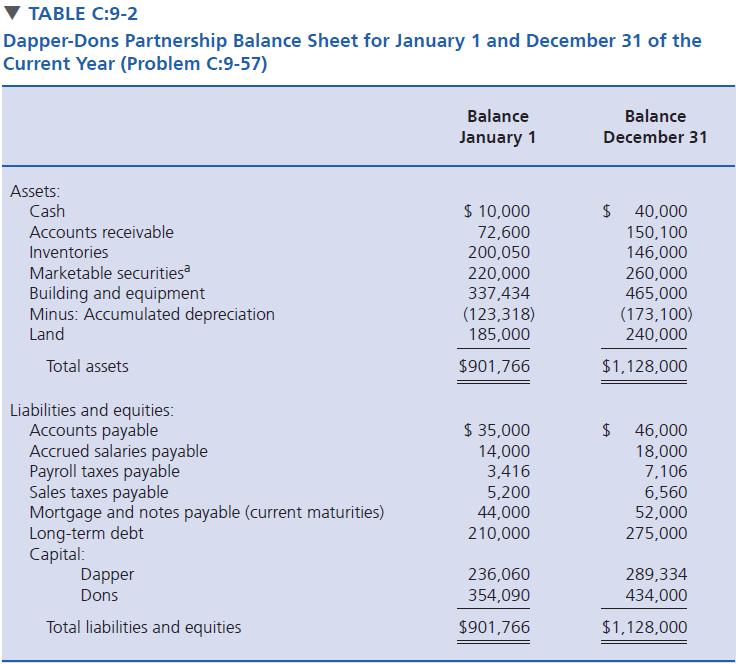

The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor men’s clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the business and has a 40% capital and profits interest. His address is 709 Brumby Way, City, ST, 54321. Jeremy Dons owns the remaining 60% interest but is not active in the business. His address is 807 Ninth Avenue, City, ST, 54321. The partnership values its inventory using the cost method and did not change the method used during the current year. The partnership uses the accrual method of accounting. The partnership has no foreign partners, no foreign transactions, no interests in foreign trusts, and no foreign financial accounts. This partnership is neither a tax shelter nor a publicly traded partnership. No changes in ownership of partnership interests occurred during the current year. The partnership made cash distributions of $155,050 and $232,576 to Dapper and Dons, respectively, on December 30 of the current year. It made no other property distributions. Financial statements for the current year are presented in Tables C:9-1 and C:9-2. Bob Dapper is the Designated Partnership Representative. Prepare a current year (2019 for this problem) partnership tax return for Dapper- ons Partnership.

Step by Step Answer:

Federal Taxation 2021 Corporations, Partnerships, Estates & Trusts

ISBN: 9780135919460

34th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse