Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2021. After

Question:

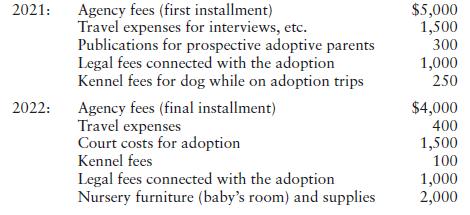

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2021. After extensive interviews and other requirements (such as financial status, etc.), Brad and Valerie were approved as eligible parents to adopt a child. The agency indicated that it might take up to two years to find a proper match. In March 2022, the adoption became final, and Brad and Valerie adopted an infant daughter (not a special needs child). Below is a list of expenses that they incurred:

Brad and Valerie’s AGI in 2021 was $70,000, and in 2022 was $90,000.

a. Compute Brad and Valerie’s qualified adoption expenses for each year.

b. Compute Brad and Valerie’s adoption credit. In which year(s) may the credit be taken?

c. Would your answer to Part b change if the adopted child was a special needs child and if a grant covered all adoption cost except for legal fees?

2021: Agency fees (first installment) Travel expenses for interviews, etc. Publications for prospective adoptive parents Legal fees connected with the adoption Kennel fees for dog while on adoption trips 2022: Agency fees (final installment) Travel expenses Court costs for adoption Kennel fees Legal fees connected with the adoption Nursery furniture (baby's room) and supplies $5,000 1,500 300 1,000 250 $4,000 400 1,500 100 1,000 2,000

Step by Step Answer:

a Valerie and Brads qualified adoption expenses include The publications qualify if they are directl...View the full answer

Pearsons Federal Taxation 2023 Comprehensive

ISBN: 9780137840656

36th Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S Hulse

Students also viewed these Business questions

-

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2018. After extensive interviews and other requirements (such as financial status, etc.), Brad and Valerie were...

-

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2014. After extensive interviews and other requirements (such as financial status, etc.), Brad and Valerie were...

-

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2012. After extensive interviews and other requirements (such as financial status, etc.), Brad and Valerie were...

-

Hewlett-Packard announced in early 1999 the spin-off of its Agilent Technologies unit to focus on its main business of computers and printers. HP retained a controlling interest until mid-2000, when...

-

Create a sample of five numbers whose mean is 6 and whose standard deviation is 0.

-

What two main criteria are used when evaluating risks during qualitative risk analysis?

-

The daily number of orders filled by the parts department of a repair shop is a random variable with \(\mu=142\) and \(\sigma=12\). According to Chebyshev's theorem, with what probability can we...

-

On January 1, 2014, Emporia Country Club purchased a new riding mower for $15,000. The mower is expected to have an 8-year life with a $3,000 salvage value . What journal entry would Emporia make at...

-

If firms and workers have adaptive expectations, what impact will contractionary monetary policy have on inflation, unemployment, and the Phillips curve? If expectations are adaptive, how will the...

-

Henry Josstick has just started his first accounting course and has prepared the following balance sheet and income statement for Omega Corp. Unfortunately, although the data for the individual items...

-

Lou and Stella North are married, file a joint return, and have two dependent children in college, Phil and Jaci. Phil attends a State University in a neighboring state, and Jaci attends a State...

-

In each of the following independent situations, determine the amount of the child and dependent care tax credit. (Assume that both taxpayers are employed and the year is 2022.) a. Brad and Bonnie...

-

The discharge in a rectangular channel 18 ft wide is 420 cfs. If the water velocity is 9 ft /s, is the flow subcritical or supercritical?

-

Course- Arts and Cultural Tourism QUESTION: Read "The impact of community-based tourism in Kyrgyzstan" Express your opinion about the importance of community-based tourism in the industry, in...

-

Course-Arts and cultural tourism QUESTION: IDENTIFY ONE COUNTRY KNOWN AS A TOP TRAVEL DESTINATION FOR SUSTAINABLE FOOD TOURISM AND EXPLAIN THE REASON FOR THEIR POPULARITY AND HOW THEY PROMOTE FOOD...

-

There is a common perception that generating and implementing innovations is a difficult process. The difficulty is related to obstacles or obstacles in innovating. In this case, Jamil Khatib in his...

-

PT. TPI will conduct a rights issue under the following conditions. Each owner 2 sheets old shares have the right to buy 1 new share at a price of IDR 3000 per share. Amount 100 million old shares...

-

How to write a thesis on a research project assignment? The topic is what are the stereotypes living with epilepsy?

-

For the system shown in Figure, I1 = I2, cT1 = cT2, cT1/I1 = 0.1 rad-1.s-1, and kT/11 = 1 s-2. Obtain the transfer function Æ1(s)/((s) and its Bode plots. Identify the resonant frequencies and...

-

Suppose the spot and six-month forward rates on the Norwegian krone are Kr 5.78 and Kr 5.86, respectively. The annual risk-free rate in the United States is 3.8 percent, and the annual risk-free rate...

-

How would our marketing system change if manufacturers were required to set fixed prices on all products sold at retail and all retailers were required to use these prices? Would a manufacturers...

-

Is price discrimination involved if a large oil company sells gasoline to taxicab associations for resale to individual taxicab operators for 2 cents a gallon less than the price charged to retail...

-

Joe Tulkin owns Tulkin Wholesale Co. He sells paper, tape, file folders, and other office supplies to about 120 retailers in nearby cities. His average retailer-customer spends about $900 a month....

-

Based on your learning and reflection, select a peer- reviewed journal article organizational leadership and discuss the following: **The problem: What argument is the author seeking to make. **The...

-

Objective: To develop a program to train executives in negotiation skills. Imagine that you are a partner of Brain Consulting, a consulting firm that offers programs to develop the soft skills of...

-

A medicine has an extremely short shelf life. The factory owner is unhappy with the slow production rate and asks the production manager about it. The production manager says she is running the...

Study smarter with the SolutionInn App