Consider the following facts: R f = R c = 18% t c = 34% t p

Question:

Rf= Rc= 18%

tc= 34%

tp= 40% for ordinary income

= 20% for capital gains

n = 5, 25, or 50 years

Other information:

€¢ The corporation is formed with a $10,000 contribution.

€¢ The corporation pays no dividends.

€¢ Assume the Sec. 1202 exclusion for gain on the sale of small business stock does not apply.

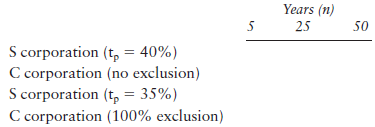

a. Using the format below, compare after-tax accumulations for each investment horizon. Should the corporation make the S election for any of these investment horizons?

b. How does your answer change if tp for ordinary income is 35% instead of 40%?

c. Now assume a 100% Sec. 1202 exclusion applies. How does your answer change in comparison to the S corporation alternative in Part b?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2017 Individuals

ISBN: 9780134420868

30th Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: