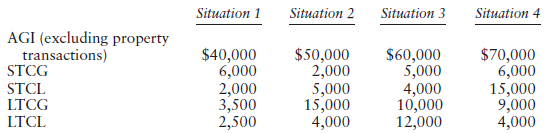

Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital

Question:

Transcribed Image Text:

Situation 2 Situation 4 Situation 1 Situation 3 AGI (excluding property transactions) STCG $60,000 $40,000 $50,000 $70,000 6,000 2,000 3,500 2,500 2,000 5,000 4,000 10,000 15,000 STCL 5,000 15,000 4,000 9,000 LTCL 4,000 12,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

Situation 1 Situation 2 Situation 3 Situation 4 A...View the full answer

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Each of the four independent situations below describes a direct financing lease in which annual lease payments of $100,000 are payable at the beginning of each year. Each is a capital lease for the...

-

Each of the four independent situations below describes a capital lease in which annual lease payments are payable at the beginning of each year. Determine the annual lease payments foreach:...

-

Each of the four independent situations below describes a lease requiring annual lease payments of $10,000. For each situation, determine the appropriate lease classification by the lessee and...

-

A Canadian packaging company wished to extend its activities in the area of convenience foods. It had pinpointed one particular area where it could supply pizza boxes to half a dozen chains of pizza...

-

Use the Fourier transform to find i (t) in the network shown if vi (t) = 2e-t u (t).

-

Rochester Manufacturing Corporation (RMC) is considering moving some of its production from traditional numerically controlled machines to a flexible manufacturing system (FMS). Its computer...

-

As indicated in Fig. P9.97, the orientation of leaves on a tree is a function of the wind speed, with the tree becoming "more streamlined" as the wind increases. The resulting drag coefficient for...

-

Answer the following multiple-choice questions. 1. GAAP stands for: (a) Governmental auditing and accounting practices. (b) Generally accepted attest principles. (c) Government audit and attest...

-

22. Assume that the following current asset and current liability accounts apply to the Harden Company for the years 2021 and 2022 (note: the ??? in the table is a figure that you must determine)....

-

1. Describe the advantages and limitations of Cambior's staffing policies. How would you compare these to the advantages and limitations of employing host-country nationals? 2. What kinds of...

-

An investor in a 28% tax bracket owns land that is a capital asset with a $50,000 basis and a holding period of three years. The investor wishes to sell the asset at a price high enough so that he...

-

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward, analyze the following data for an unmarried individual for the period 2014 through 2017....

-

How would you explain that the ML High-Yield Bond Index was more highly correlated with the NYSE composite stock index than the ML Aggregate Bond Index?

-

kindly solve this question for me 18 Assignment 2 (chapters 20-23), Due Date: 27 June 11:00 PM Submit your assignment as follows: This assignment will be made available as a quiz activity under...

-

The Alpine House, Incorporated, is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 3 1 : Amount Sales $ 1 , 4 5 2 , 0 0 0 Selling price...

-

Make a Word Search puzzle. Your program should contain the following features: 1. A matrix that stores the board. Each element of the matrix should store a letter (either as a character or a string)....

-

Original Built, LLC has budgeted the following for 2023: Purchases $420,000 Beginning Accounts Payable $95,000 Ending Accounts Payable $92,000 Calculate the budgeted cash payments for Original Built,...

-

Colleen Company has gathered the following data pertaining to activities it performed for two of its major customers. Jerry, Incorporated Kate Company Number of orders 5 3 0 Units per order 1 , 0 0 0...

-

Write and simplify, but do not evaluate, an integral with respect to x that gives the length of the following curves on the given interval. y = x 3 + 2 on [-2, 5]

-

Before the latest financial crisis and recession, when was the largest recession of the past 50 years, and what was the cumulative loss in output over the course of the slowdown?

-

Hal and Wanda, his wife, are in the 35% marginal tax bracket in the current year. Wanda fraudulently omits from their joint return $50,000 of gross income. Hal does not participate in or know of her...

-

Frank, a calendar year taxpayer, reports $100,000 of gross income and $60,000 of taxable income on his Year 1 return, which he files on March 12 of Year 2. He fails to report on the return a $52,000...

-

Refer to the previous problem. Assume Frank subsequently commits fraud with respect to his Year 1 return as late as October 8, of Year 3. When does the limitations period for charging Frank with...

-

Explain how the OS and Utility programs work with application software. Summarize the features of several embedded operating systems course: introduction to information technology code: EBI...

-

Determine the complexity of the following pseudocode snippets in Big-O and Big-Q2. Do these code snippets have a Big-e? What are the functions doing? 1) my_func(some_nums) result = 0 for (num in...

-

Please explain and describe what are input and output devices. Explain what the differences are between an operating system, an embedded operating system, and a network operating system. Explain and...

Study smarter with the SolutionInn App