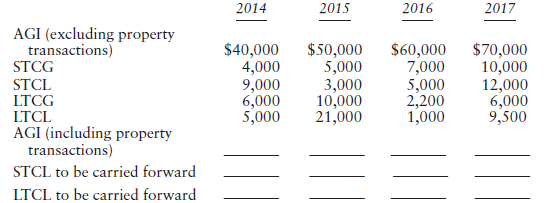

To better understand the rules for offsetting capital losses and how to treat capital losses carried forward,

Question:

Transcribed Image Text:

2015 2016 2014 2017 AGI (excluding property transactions) $40,000 4,000 $70,000 10,000 12,000 6,000 9,500 $50,000 5,000 $60,000 7,000 5,000 2,200 STCG 3,000 10,000 21,000 9,000 6,000 5,000 LTCG 1,000 AGI (including property transactions) STCL to be carried forward LTCL to be carried forward

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

2014 2015 2016 2017 AGI ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

An executive researcher wants to better understand the factors that explain differences in salaries for marketing majors. He decides to estimate two models: y = 0 + 1d1 + (Model1) and y = 0 + 1d1 +...

-

To better understand the morphine example that we have been using in this chapter, think of an example in your own life in which you can see the role played by tolerance and context. How would you go...

-

In one of many attempts to better understand the correlation between social distancing and new COVID-19 infections, the Signer Lab at the University of California San Diego had reported that a single...

-

The word culture is used in many ways, such as when people talk about national culture, organisational culture, political culture or youth culture. In which ways do the meanings of culture differ?

-

The input signal for the network shown is vi(t) = 10e-5t (t) V. Determine the total 1- energy content of the output vo (t).

-

The Arnold Palmer Hospital (APH) in Orlando, Florida, is one of the busiest and most respected hospitals for the medical treatment of children and women in the U.S. Since its opening on golfing...

-

By appropriate streamlining, the drag coefficient for an airplane is reduced by \(12 \%\) while the frontal area remains the same. For the same power output, by what percentage is the flight speed...

-

Arrow Enterprises uses a standard costing system. The standard cost sheet for product no. 549 follows. Direct materials: 4 units @ $6.50 .... $26.00 Direct labor: 8 hours @ $8.50 ....... 68 Variable...

-

In its income statement for the year ended December 31, 2025, Blossom Inc. reported the following condensed data. Operating expenses $710,000 Interest revenue $23,000 Cost of goods sold 1,246,000...

-

The reaction shown below yields one major addition product as a racemic mixture. For the mechanism stop below, draw curved arrows to show electron reorganization. Consider the formation of just one...

-

Consider the four independent situations below for an unmarried individual, and analyze the effects of the capital gains and losses on the individuals AGI. For each case, determine AGI after...

-

The Michigan Corporation owns 20% of the Wolverine Corporation. The Wolverine stock was acquired eight years ago to ensure a steady supply of raw materials. Michigan also owns 30% of Spartan...

-

Figure 2.37 shows how the pumping rate of a persons heart changes after bleeding. (a) Find the slope of the line tangent to the graph at time 2 hours. Give units. (b) Using your answer to part (a),...

-

Practice Questions on Enumerations. 1. Create an enum called Suit that contains constants for the four suits in a standard deck of cards (Clubs, Diamonds, Hearts, and Spades). 2. Create an enum...

-

Answer only in JAVA language MyStack Class: importjava.util.ArrayList; public classMyStack { public final ArrayList list = new ArrayList (); public int getSize(){ return list.size(); } ...

-

Hancock Company reported the following account balances at December 3 1 , 2 0 2 7 : Sales revenue . . . . . . . . . . . . . . . $ 2 8 4 , 0 0 0 Dividends . . . . . . . . . . . . . . . . . . . $ 5 1 ,...

-

4. What is the characteristic feature observed in leukocytes ofindividuals with Chediak-Higashi syndrome? A) Enhanced ability to kill ingested microorganisms B) Defective neutrophil chemotaxis C)...

-

Brinx is currently a levered firm. The company has a levered cost of equity of 12.60 percent and a pretax cost of debt of 6.5 percent. If the company is unlevered, its cost of capital will be 9.54%....

-

Explain the steps required to find the length of a curve x = g(y) between y = c and y = d.

-

(8%) Problem 6: A student attaches a f= 3.5 kHz oscillator to one end of a metal rail of length L = 25 m. The student turns on the oscillator and uses a piezoelectric gauge at the other end to...

-

Wilma earns no income in the current year but files a joint return with her husband, Hank. The return reports $40,000 of gross income and AGI, and $24,000 of taxable income. Hank realized $12,000 of...

-

Joe and Joan file a joint return for the current year. They are in the 35% marginal tax bracket. Unbeknownst to Joe, Joan fails to report on the return the $8,000 value of a prize she won. She,...

-

Your client, Meade Technical Solutions, proposes to merge with Dealy Cyberlabs. In advance of the merger, you (a) issue an opinion concerning the FMV of Dealy, (b) prepare pro forma financials for...

-

Many American car manufacturers are located in the Southeast. Due to hurricane season, the Southeast has gotten a significant amount of rain, causing vast flooding. How is the supply of cars impacted?

-

Suppose that the cost in dollars for a weekly production of x tons of sugar is given by the following function (a) Find the marginal cost. 1 C(x) = x+3x+200. (b) Find the cost and marginal cost when...

-

16. An IEEE standard 32-bit floating point number is N = -15 x 2E-127 x 1.F, where S is the sign bit, F is the fractional mantissa, and E the biased exponent. a. Convert the decimal number 123.5 into...

Study smarter with the SolutionInn App