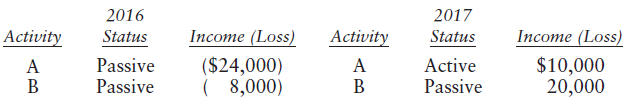

Question: In 2016, Mark purchased two separate activities. Information regarding these activities for 2016 and 2017 is as follows: The 2016 losses were suspended losses for

The 2016 losses were suspended losses for that year. During 2017, Mark also reports salary income of $120,000 and interest and dividend income of $20,000. Compute the amount (if any) of losses attributable to Activities A and B that are deductible in 2017 and any suspended losses carried to 2018.

2016 Status 2017 Status Income (Loss) Income (Loss) Activity Activity ($24,000) ( 8,000) Active $10,000 20,000 Passive Passive A A Passive

Step by Step Solution

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Although in 2017 activity A is not a passive activity it is treated ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1445_6054778c1ad2c_646178.pdf

180 KBs PDF File

1445_6054778c1ad2c_646178.docx

120 KBs Word File