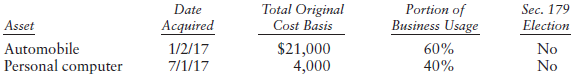

In 2017, Trish, a self-employed CPA and calendar year taxpayer, acquires and places in service an automobile

Question:

For each asset, calculate the MACRS current year depreciation deduction assuming Trish does not elect Sec. 179 expensing and elects out of bonus depreciation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: