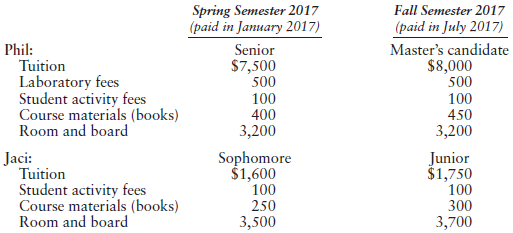

Lou and Stella North are married, file a joint return, and have two dependent children in college,

Question:

a. Compute any education credits that the Norths may claim in 2017.

b. How would your answer in Part a change if Phil received an academic scholarship of $3,000 (excluded from gross income) for each semester?

c. How would your answer in Part a change if Lou and Stella€™s modified AGI was $175,000?

d. How would your answer in Part a change if Phil had been a junior during Spring semester and a senior during Fall semester?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: