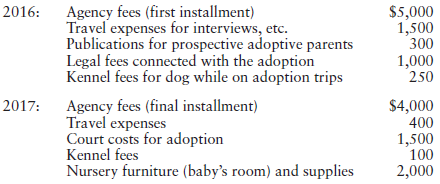

Brad and Valerie decided to adopt a child and contacted an adoption agency in August 2016. After

Question:

Brad and Valerie€™s AGI in 2016 was $70,000, and in 2017 was $90,000.

a. Compute Brad and Valerie€™s qualified adoption expenses for each year.

b. Compute Brad and Valerie€™s adoption credit. In which year(s) may the credit be taken?

c. Would your answer to Part b change if the adopted child was a special needs child and if a grant covered all adoption cost except for legal fees?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted: