Mike and Linda are a married couple who file jointly. They have three dependent children who are

Question:

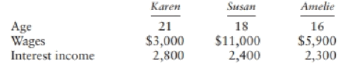

Mike and Linda are a married couple who file jointly. They have three dependent children who are full-time students in 2019. Mike and Linda provided $8,000 of support for each child. Information for each child is as fol lows:

Compute each child's tax, assuming the interest income is taxable.

Transcribed Image Text:

Karen Susan Amelie Age Wages Interest income 21 18 16 $3,000 2,800 $11,000 2,400 $5,900 2,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

Karen Karens gross tax is 245At age 21 Karen is subject to the kiddie tax because she is a fulltime ...View the full answer

Answered By

Aysha Ali

my name is ayesha ali. i have done my matriculation in science topics with a+ . then i got admission in the field of computer science and technology in punjab college, lahore. i have passed my final examination of college with a+ also. after that, i got admission in the biggest university of pakistan which is university of the punjab. i am studying business and information technology in my university. i always stand first in my class. i am very brilliant client. my experts always appreciate my work. my projects are very popular in my university because i always complete my work with extreme devotion. i have a great knowledge about all major science topics. science topics always remain my favorite topics. i am also a home expert. i teach many clients at my home ranging from pre-school level to university level. my clients always show excellent result. i am expert in writing essays, reports, speeches, researches and all type of projects. i also have a vast knowledge about business, marketing, cost accounting and finance. i am also expert in making presentations on powerpoint and microsoft word. if you need any sort of help in any topic, please dont hesitate to consult with me. i will provide you the best work at a very reasonable price. i am quality oriented and i have 5 year experience in the following field.

matriculation in science topics; inter in computer science; bachelors in business and information technology

_embed src=http://www.clocklink.com/clocks/0018-orange.swf?timezone=usa_albany& width=200 height=200 wmode=transparent type=application/x-shockwave-flash_

4.40+

11+ Reviews

14+ Question Solved

Related Book For

Federal Taxation 2020 Comprehensive

ISBN: 9780135196274

33rd Edition

Authors: Timothy J. Rupert, Kenneth E. Anderson, David S. Hulse

Question Posted:

Students also viewed these Business questions

-

Joe and Jane Keller are a married couple who file a joint income tax return. The couple's taxable income was $102,000. How much federal taxes did they owe? Use the tax tables given in the chapter.

-

Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was...

-

Susan and Stan Britton are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year...

-

Steel It began January with 55 units of iron inventory that cost $35 each. During January, the company completed the following inventory transactions: Requirements 1. Prepare a perpetual inventory...

-

Mercury is often used in barometers as depicted in Figure P2.2.3. This is because the vapor pressure of mercury is low enough to be ignored, and because it is so dense (sp. gr. = 13. 6) the tube can...

-

A UML model Ultra Light Style of a business process has (a) activity diagram (b) activity diagram and list of participants (c) activity diagram and class diagram (d) None of these

-

Stone Brewing Co. is a San Diego brewer that has sold its beers for over two decades. Stone has maintained its trademark and brand from the beginning, registering the STONE mark in 1998. Stone has...

-

Ralph Janaro simply does not have time to analyze all of the items in his company's inventory. As a young manager, he has more important things to do. The following is a table of six items in...

-

Why are both ER Diagrams and Relational Modeling needed when a database system is developed?

-

A simple porous medium is composed of equal nonconduct- ing spheres, the packing of which is cubic, as shown in Fig. 1.32. The pores are filled with a liquid of resistivity Rw. a. Determine the...

-

Lucy is 17 years old and a dependent of her parents. She receives $9,000 of wages from a pan-time job and $10,400 of taxable interest from bonds she inherited. Determine Lucy's taxable income and tax.

-

Virginia is a cash-basis, calendar-year taxpayer. Her salary is $90,000, and she is single. She plans to purchase a residence in 2020. She anticipates her property taxes and interest will total...

-

Describe the mechanical limitation on the deduction for interest on qualified educational loans.

-

Barbara Beck and Joan Bishop are thinking about opening a new restaurant. Ms. Bishop has extensive marketing experience but does not know that much about food preparation. However, Ms. Beck is an...

-

Let An = [0,2 - ] 2 8585 a) Find Un = 1 6) Find A = 1

-

Explain what Habermas means by Strategic Intent, and compare that to Communicative Intent. How do these two concepts parallel how Aristotle and Plato differed on Rhetoric? In answering this question,...

-

Different approaches to acting What qualities make a good actor? The importance of acting and actors in theater and entertainment

-

Hercules Co. is considering getting rid of manual production and using a machine instead. With manual production, there are two workers and one supervisor. Each worker makes $20,750 annually, and...

-

In 2014, Lai Inc. reported a profit margin of 5% before discontinued operations and a profit margin of 8% after discontinued operations. In 2015, the company had no discontinued operations and...

-

F.(3e* -2x 3 sin(2x)) is equal to 2 3 Cos 8. IT 3, t (4+@ 2 3, 1+o 1 4 Cos 4 4 1 3. 1 +4cos V7 (1+o 4 1 4 Cos 4 1+0 4-

-

Refer to the facts in Problem C:3-60. Assume that Omega Corporations employer identification number is XX-1234321 and that Omegas income statement is unaudited and non-tax based (it is GAAP based)....

-

Refer to the facts in Problem C:3-58, and prepare Form 1120, Schedule M-1 based on these facts.

-

Permtemp Corporation (EIN: XX-1234567) formed in 2018 and, for that year, reported the following book income statement and balance sheet, excluding the federal income tax expense, deferred tax...

-

Find the minimum Sum of Products (SOP) for these expressions using a Karnaugh map 6) f(a,b,c) m(1,2,3,4,6) 7) g(w,x,y,z) = m(1,3,5,6,7,13,14) + d(8,10,12) 8) f = wx'yz+w'xyz + w'x'y'z' + w'xy'z +...

-

4. Write a Matlab program to print the following 5 5 10 5 10 5 10 5 10 5 10 5 10 5 10 5 10 5555555 20 20 20 20 20 222222 25 25 25 330 35 25 30 35 40 20 25 30 35 40 45 5 10 15 20 25 30 35 40 45 50

-

What is the impact of cultural diversity on employees' performance specifically in privet sectors? Explain.

Study smarter with the SolutionInn App