Refer to the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the company is an S

Question:

Refer to the facts in Tax Form/Return Preparation Problem C:9-58. Now assume the company is an S corporation rather than a partnership. Additional facts are as follows:

Drs. Bailey and Firth formed the corporation on January 1, 2015, and the corporation immediately elected S corporation status effective at the beginning of 2015.

Upon the formation of the corporation, Dr. Bailey received common stock worth $600,000, and Dr. Firth received common stock worth $1.4 million.

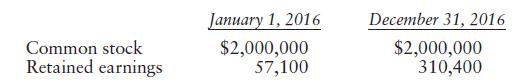

The balance sheet information is the same as in Table C:9-3 except the equity section is as follows:

The $100,000 paid to Dr. Bailey is salary constituting W-2 wages (instead of a guaranteed payment). Ignore employment taxes (Social Security, etc.) on Dr. Bailey's salary.

Qualified production activities income (QPAI) still equals $1.6 million, but employer?s W-2 wages allocable to U.S. production activities equal $800,000 (because of Dr. Bailey's salary). The company, being an eligible small pass-through S corporation, uses the small business simplification overall method for reporting these activities (see discussion for Line 12d of Schedule K and Line 12 of Schedule K-1 in the Form 1120S instructions).

Use book numbers for Schedule L and Schedule M-1 in Form 1120S.

Required:?

Prepare the 2016 S corporation tax return (Form the 1120S), including the following additional schedules and forms: Schedule D, Form 4562, and Schedule K-1. Optional:

(1) Complete Schedule M-2 in Form 1120S even though the company has never been a C corporation. For this purpose, the accumulated adjustments account at the beginning of 2016 is $57,100.

(2) Prepare a schedule for each shareholder?s basis in his or her S corporation stock. For this purpose, Bailey?s stock basis at the beginning of 2016 is $617,130 and Firth?s is $1,247,970.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson