Question: Date March 1 Activities Beginning inventory March 5 Purchase March 9 Sales March 18 Purchase March 25 Purchase March 29 Sales Totals 70 units

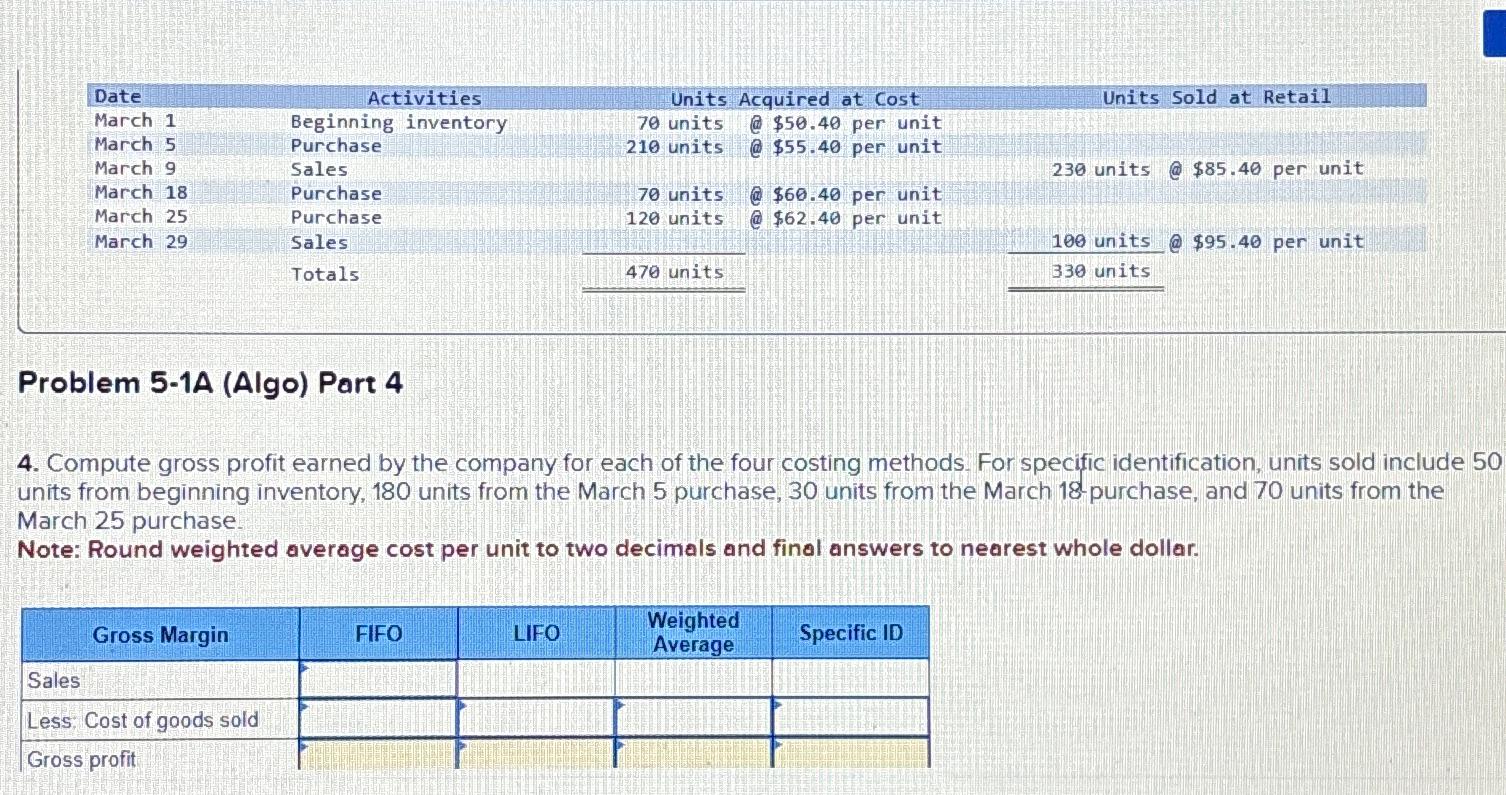

Date March 1 Activities Beginning inventory March 5 Purchase March 9 Sales March 18 Purchase March 25 Purchase March 29 Sales Totals 70 units 210 units Units Acquired at Cost @$50.40 per unit @ $55.40 per unit Units Sold at Retail 230 units @ $85.40 per unit 70 units 120 units @$60.40 per unit @$62.40 per unit 470 units 100 units @$95.40 per unit 330 units Problem 5-1A (Algo) Part 4 4. Compute gross profit earned by the company for each of the four costing methods. For specific identification, units sold include 50 units from beginning inventory, 180 units from the March 5 purchase, 30 units from the March 18-purchase, and 70 units from the March 25 purchase. Note: Round weighted average cost per unit to two decimals and final answers to nearest whole dollar. Gross Margin FIFO LIFO Weighted Average Specific ID Sales Less: Cost of goods sold Gross profit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts