Question: Sandy will earn a $100,000 bonus that can be split between current and deferred compensation in any of the following ways: Current (BT$)* Deferred (BT$)*

Sandy will earn a $100,000 bonus that can be split between current and deferred compensation in any of the following ways:

Current (BT$)* Deferred (BT$)*

$100,000...................................................$ €“0€“

80,000.....................................................20,000

60,000.....................................................40,000

40,000.....................................................60,000

20,000.....................................................80,000

€“0€“.........................................................100,000

* The numbers in the above lists are BT$ as in the text formulas. Thus, the numbers in the second column are not BT$ × Dn.

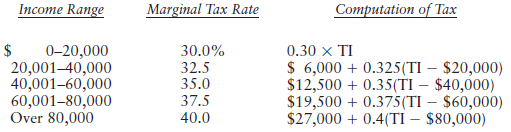

Assume that Sandy is subject to the following progressive tax rate schedule in the current and future years:

€¢ Corporate tax rates are as follows: tco = .35, tcn = .34.

€¢ Rates of return are as follows: rc = .08; rp = .07.

€¢ The length of deferral is five years, i.e., n = 5.

a. What is the best way for Sandy to split the $100,000 bonus given a level of Dn that makes the corporation indifferent?

b. Now assume the bonus allocations are not restricted to $20,000 increments. What is the optimal allocation of the current and deferred bonus given the level of Dn that makes the employer indifferent?

Income Range Marginal Tax Rate Computation of Tax 0-20,000 20,001-40,000 40,00160,000 60,001-80,000 0.30 x TI $ 6,000 + 0.325(TI $20,000) $12,500 + 0.35(TI $40,000) $19,500 + 0.375(TI $60,000) $27,000 + 0.4(TI $80,000) 30.0% 32.5 35.0 37.5 40.0 Over 80,000

Step by Step Solution

3.29 Rating (164 Votes )

There are 3 Steps involved in it

a Sandy should take 60000 of current bonus and defer 40000 In this problem a particular level of bonus is not subject to one tax rate Instead because of the progressive tax rate structure a given amou... View full answer

Get step-by-step solutions from verified subject matter experts