Use Exhibit 24.1 to provide the required information for Warbler Corporation, whose Federal taxable income totals $10

Question:

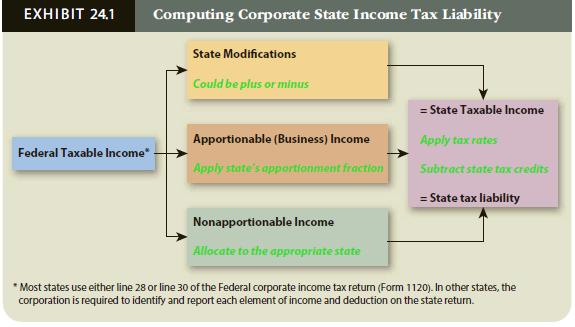

Use Exhibit 24.1 to provide the required information for Warbler Corporation, whose Federal taxable income totals $10 million. Warbler apportions 70% of its manufacturing income to State C. Warbler generates $4 million of nonapportionable income each year, and 30% of that income is allocated to C. Applying the state income tax modifications, Warbler’s total business income from the manufacturing operation this year is $12 million.

a. How much of Warbler’s manufacturing income does State C tax?

b. How much of Warbler’s allocable income does State C tax?

c. Explain your results.

Exhibit 24.1

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted: