Will, a bachelor, died in 2017. At that time, his sole asset was cash of $6 million.

Question:

a. What was Will€™s estate tax base?

b. How would your answer to Part a change if Will made the first gift in 1974 (instead of 1987)?

Transcribed Image Text:

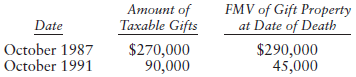

FMV of Gift Property at Date of Death Атоunt of Taxable Gifts $270,000 90,000 Date October 1987 October 1991 $290,000 45,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

a Gross estate and taxable estate 6000000 Plus Adjusted taxable gifts 360000 Es...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Federal Taxation 2018 Comprehensive

ISBN: 9780134532387

31st Edition

Authors: Thomas R. Pope, Timothy J. Rupert, Kenneth E. Anderson

Question Posted:

Students also viewed these Business questions

-

Cate Cole died in 2014, and her will left her entire estate in equal shares to her two adult children, Calvin and Corrine. Both children anticipate being in the top income tax bracket for at least...

-

Will, a bachelor, died in 2014. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses and no charitable bequests. His gift history was as...

-

Will, a bachelor, died in 2013. At that time, his sole asset was cash of $6 million. Assume no debts or funeral and administration expenses. His gift history was as follows: a. What was Will's estate...

-

The population of a certain colony of bacteria increases by 5% each hour. After 7 hours, what is the percent increase in the population over the initial population?

-

A researcher uses a matched-subjects design to investigate whether single people who own pets are generally happier than singles without pets. A mood inventory questionnaire is administered to a...

-

Given the following hypotheses: H0: = 100 H1: 100 A random sample of six resulted in the following values: 118, 105, 112, 119, 105, and 111. Assume a normal population. Using the .05 significance...

-

An oil preheater consists of a single tube of \(10-\mathrm{mm}\) diameter and 5-m length, with its surface maintained at \(180^{\circ} \mathrm{C}\) by swirling combustion gases. The engine oil (new)...

-

TBN manufactures jumpers for retail stores. John, the accountant of TBN, gets concerned about TBNs standard costing system. The budgeted and actual amounts below for August 2019 were drawn from its...

-

Poehling Medical Center has a single operating room that is used by local physicians to perform surgical procedures. The cost of using the operating room is accumulated by each patient procedure and...

-

1. Discuss the relationship between the corporate human resources structure and operations at the plant level. What impact, if any, did it have on the present situation? 2. How should Joyce Newcombe...

-

Sam Snider died February 14, 2016, survived by his spouse Janet and several children. Sam had not made any taxable gifts. Sams gross estate was $7 million. In each of the following independent...

-

Bess, a widow, died in October 2017. Her gross estate, which totaled $7 million, included a $100,000 life insurance policy on her life that she gave away in 2015. The taxable gift that arose from...

-

Castillo Products Company, described in Problem 7, improved its operations from a net loss in 2009 to a net profit in 2010. While the founders, Cindy and Rob Castillo, are happy about these...

-

Milo receives a commission of 2% on all sales. If his commission on a sale was $31.00 , find the cost of the item he sold.

-

How does International Benefits work? what issues need further research with international benefits? example of a international company benefit.

-

Lillibridge & Friends, Incorporated provides you with the following data for its single product: Sales price per unit Fixed costs (per quarter): Selling, general, and administrative (SG&A)...

-

How many minutes would you have to walk in November so that your mean for the 11 months would be 2 percentage points more than your mean for the 10 months? 178 + 182 + 188 +198 + 205 +219 +230 + 245...

-

Your restaurant bill is $123.50. If you want to leave a 15% tip, how much will you spend?

-

Hmmm, Stephanie muses, Maybe going with a bank is a better idea, because I know that Brenda would want to be actively involved and she and I dont always have the same ideas. Victoria offered, Why...

-

Write the statement to store the contents of the txtAge control in an Integer variable named intAge.

-

On February 15, 2017, Jamal, who is single and age 30, establishes a traditional IRA and contributes $5,500 to the account. Jamal's adjusted gross income is $67,000 in 2016 and $57,000 in 2017. Jamal...

-

On March 1, 2016, Sarah entered into a three-year lease of an automobile used exclusively in her business. The automobile's FMV was $58,500 at the inception of the lease. Sarah made ten monthly lease...

-

Woburn Corporation uses the calendar year as its tax year. Woburn purchases and places into service $850,000 of depreciable property during 2016: You are working in Woburn's tax department and are...

-

Assume that you are the leadership team of a convenience store chain that has more than 300 outlets. The company is facing an inventory shrinkage problem, and store managers report that the main...

-

1 . An employee at Amy's candles has noticed that some order quantities in the two reports presented are different although the order numbers are the same. We normally refer to such data as dirty....

-

On Monday, April 5, 2010, just before 3:00 in the afternoon, miners at Massey Energy Corporation's Upper Big Branch coal mine in southern West Virginia were in the process of a routine shift change....

Study smarter with the SolutionInn App