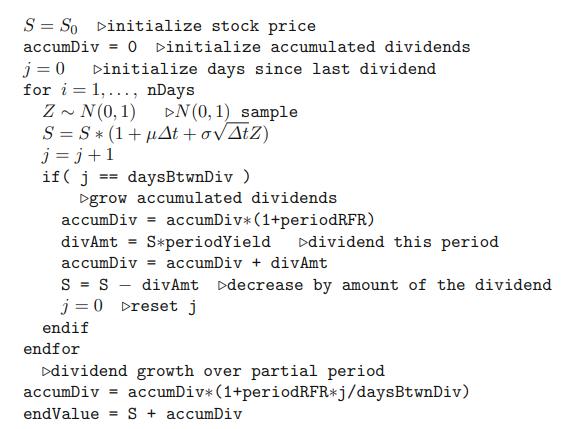

Algorithm 6 assumes that the equity is purchased at the beginning of the dividend period. If the

Question:

Algorithm 6 assumes that the equity is purchased at the beginning of the dividend period. If the stock is held for an exact multiple of the dividend period, then the annualized return should be exactly the dividend yield. But what if the stock is bought or sold at mid-term intervals? For example shortly before ex-dividend day? Explore the annual return under various ownership periods with respect to the ex-dividend date.

Data given in Algorithm 6

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: