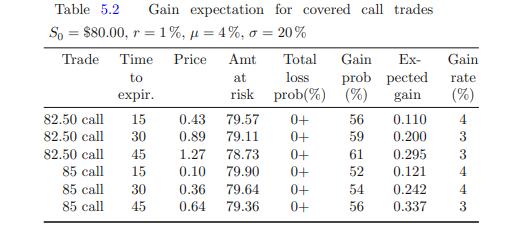

In Table 5.2 the fifth line gives the gain expectation for $5 OTM 30 day covered calls

Question:

In Table 5.2 the fifth line gives the gain expectation for $5 OTM 30 day covered calls as 0.242 with probability of a gain as 54 %. Since the gain could be anywhere between 0 and 5.36, assume it is the mid-point, 2.68. Further assume that the trade loses $1 36 % of the time. How much does it lose the remaining 10 % of the time? Under these conditions, what is the Kelly fraction of ones portfolio to be allocated to this investment?

Data given in table 5.2

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: