Question: Using the parameters in the header of Table 5.1, except for the drift, and analyze the OTM call trade (85 strike) for various values of

Using the parameters in the header of Table 5.1, except for the drift, and analyze the OTM call trade (85 strike) for various values of drift; for example μ = 0.02, μ = 0.04, and μ = 0.06.

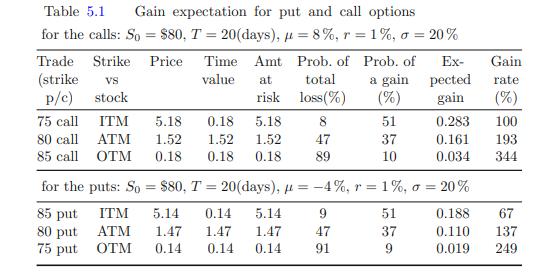

Data given in Table 5.1

Table 5.1 Gain expectation for put and call options for the calls: So = $80, T = 20(days), p=8%, r = 1%, o = 20% Trade Strike Price Time Amt Prob. of Prob. of Ex- (strike VS value at total a gain pected p/c) stock loss (%) (%) gain ITM ATM risk 75 call 5.18 0.18 5.18 80 call 1.52 1.52 1.52 85 call OTM 0.18 0.18 0.18 8 47 89 51 37 10 9 47 91 0.283 0.161 0.034 for the puts: So = $80, T = 20(days), = -4%, r = 1%, o = 20% 85 put ITM 5.14 0.14 5.14 51 0.188 80 put ATM 1.47 1.47 1.47 37 0.110 75 put OTM 0.14 0.14 0.14 9 0.019 Gain rate (%) 100 193 344 67 137 249

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

alright based on the data in Table 51 for an OTM call trade 85 strike heres the analysis for various ... View full answer

Get step-by-step solutions from verified subject matter experts