Question: Using the parameters in the header of Table 5.4 except for the starting stock price S 0 , analyze the 80/75 put spread for various

Using the parameters in the header of Table 5.4 except for the starting stock price S0, analyze the 80/75 put spread for various starting prices ITM; for example S0 = 79, S0 = 77, S0 = 75.

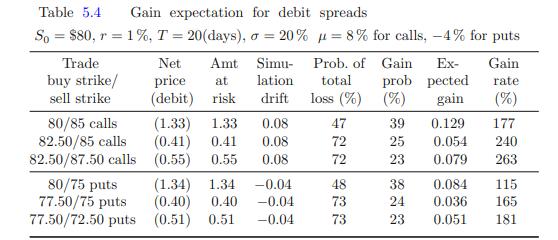

Data given in Table 5.4

Table 5.4 Gain expectation for debit spreads So = $80, r = 1%, T = 20(days), o = 20% = 8% for calls, -4% for puts Trade buy strike/ sell strike 80/85 calls 82.50/85 calls 82.50/87.50 calls 80/75 puts 77.50/75 puts 77.50/72.50 puts Amt Simu- Prob. of Gain total prob lation drift loss (%) (%) Net at price (debit) risk (1.33) 1.33 0.08 (0.41) 0.41 0.08 (0.55) 0.55 0.08 (1.34) 1.34 -0.04 (0.40) 0.40 -0.04 (0.51) 0.51 -0.04 47 #7272148373 39 0.129 25 0.054 0.079 23 Ex- pected gain 38 24 23 0.084 0.036 0.051 Gain rate (%) 177 240 263 115 165 181

Step by Step Solution

3.33 Rating (144 Votes )

There are 3 Steps involved in it

Analysis of 8075 Put Spread for Various Starting Prices ITM Starting Stock Price S0 79 Net debit 134 ... View full answer

Get step-by-step solutions from verified subject matter experts