Bens Patisserie had the following balances in its ledger at 30 June 2019. Bens Patisseries financial year

Question:

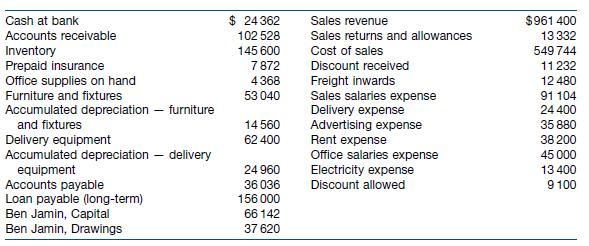

Ben’s Patisserie had the following balances in its ledger at 30 June 2019.

Ben’s Patisserie’s financial year ends on 30 June. During the year the accountant prepared monthly statements using worksheets, but no adjusting entries were made in the journals and ledgers. Data for the year‐end adjustments are as follows.

1. Prepaid insurance, 30 June 2019, $1312.

2. Office supplies on hand, 30 June 2019, $2324.

3. Depreciation expense for year, furniture and fixtures, $4820.

4. Depreciation expense for year, delivery equipment, $13 230.

5. Sales salaries payable but unrecorded, $3200.

6. Office salaries payable but unrecorded, $880.

Required

(a) Prepare a worksheet for the year ended 30 June 2019.

(b) Prepare an income statement for the year ended 30 June 2019.

(c) Prepare a balance sheet as at 30 June 2019.

(d) Make the necessary adjusting entries.

(e) Make the closing entries.

(f) Make any necessary reversing entries.

Step by Step Answer:

Financial Accounting

ISBN: 9780730363217

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Claire Beattie, Andreas Hellmann, Jodie Maxfield