Question: P11-67A. (Learning Objectives 3, 4, 5, 6: Preparing the statement of cash flowsdirect and indirect methods) To prepare the statement of cash flows, accountants for

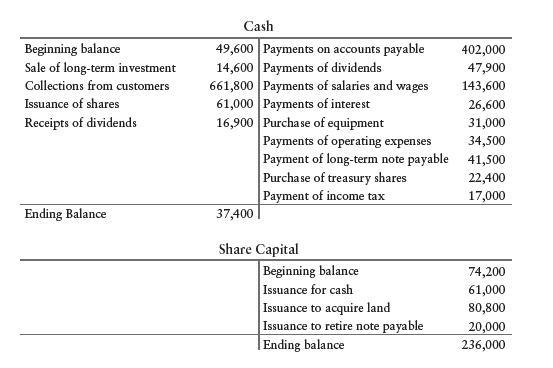

P11-67A. (Learning Objectives 3, 4, 5, 6: Preparing the statement of cash flows—direct and indirect methods) To prepare the statement of cash flows, accountants for Daisy Electric Company have summarized 20X6’s activities in two accounts as follows:

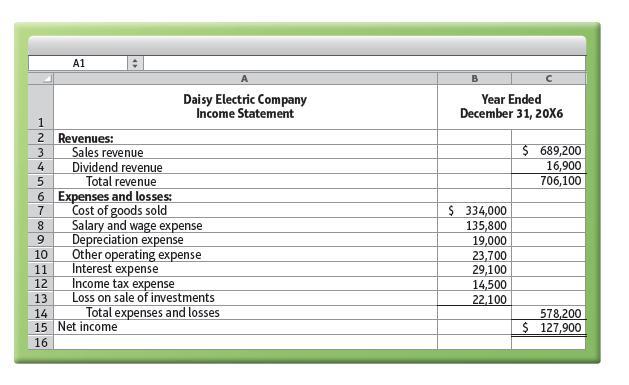

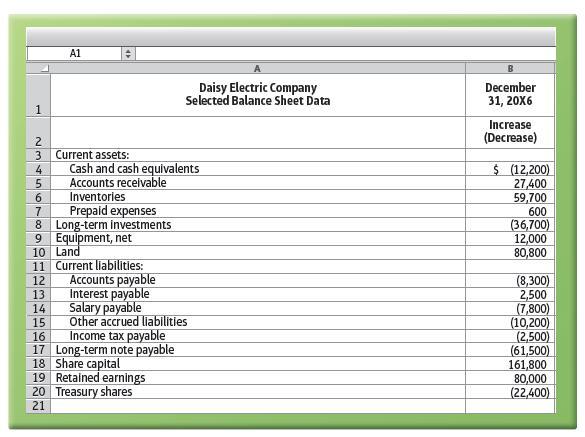

Daisy’s 20X6 Income Statement and Balance Sheet data follow:

Requirements 1. Prepare the statement of cash flows of Daisy Electric Company for the year ended December 31, 20X6, using the direct method to report operating activities. Also prepare the accompanying schedule of noncash investing and financing activities.

2. Use Daisy’s 20X6 Income Statement and Balance Sheet to prepare a supplementary schedule of cash flows from operating activities by using the indirect method.

Cash Beginning balance Sale of long-term investment 49,600 Payments on accounts payable 14,600 Payments of dividends 402,000 47,900 Collections from customers Issuance of shares Receipts of dividends 661,800 Payments of salaries and wages 143,600 61,000 Payments of interest 26,600 16,900 Purchase of equipment 31,000 Payments of operating expenses 34,500 Payment of long-term note payable 41,500 Purchase of treasury shares 22,400 Payment of income tax 17,000 Ending Balance 37,400 Share Capital Beginning balance 74,200 Issuance for cash 61,000 Issuance to acquire land 80,800 Issuance to retire note payable 20,000 Ending balance 236,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts