Question: P12-61B. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Schmid Optical Mart follow: Other information: 1. Market price

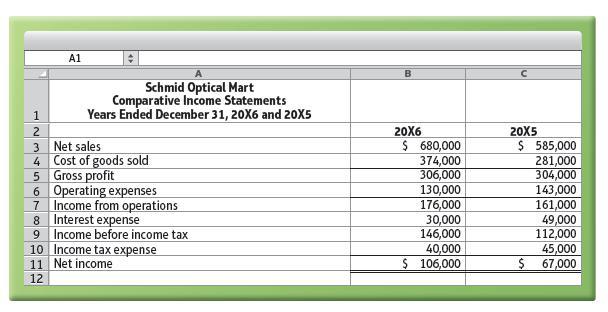

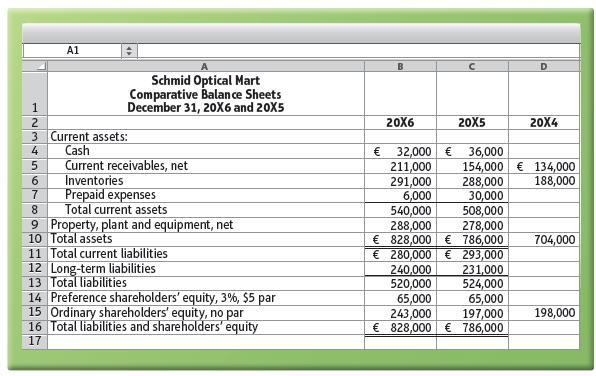

P12-61B. (Learning Objective 4: Using ratios to evaluate a share investment) Comparative financial statement data of Schmid Optical Mart follow:

Other information:

1. Market price of Schmid ordinary share: €78.12 at December 31, 20X6, and €59.10 at December 31, 20X5.

2. Ordinary shares outstanding: 19,000 during 20X6 and 17,000 during 20X5.

Requirements 1. Compute the following ratios for 20X6 and 20X5:

a. Current ratio

d. Return on ordinary shareholders’ equity

b. Inventory turnover

e. Earnings per ordinary share

c. Times-interest-earned ratio

f. Price/earnings ratio 2. Decide whether

(a) Schmid’s financial position improved or deteriorated during 20X6 and

(b) the investment attractiveness of Schmid’s ordinary shares appears to have increased or decreased.

3. How will what you have learned in this problem help in the evaluation of an investment?

A1 Schmid Optical Mart Comparative Income Statements Years Ended December 31, 20X6 and 20X5 1 2 3 Net sales 4 Cost of goods sold 5 Gross profit 6 Operating expenses 7 Income from operations 8 Interest expense 9 Income before income tax 10 Income tax expense 11 Net income 20X6 $ 680,000 374,000 306,000 130,000 176,000 30,000 146,000 40,000 $ 106,000 20X5 $ 585,000 281,000 304,000 143,000 161,000 49,000 112,000 45,000 $ 67,000 12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts