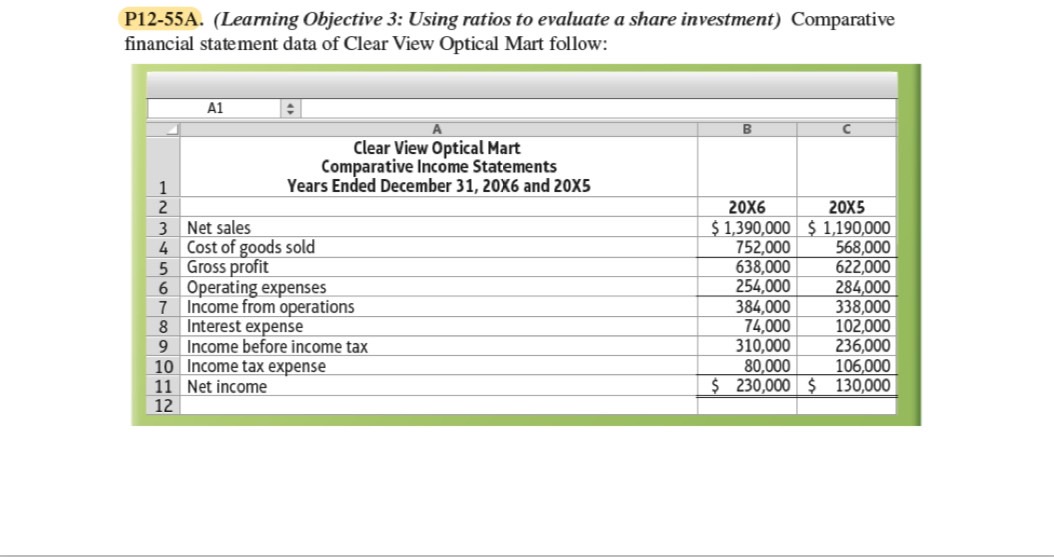

Question: P12-55A. (Learning Objective 3: Using ratios to evaluate a share investment) Comparative financial statement data of Clear View Optical Mart follow: Other information: 1. Market

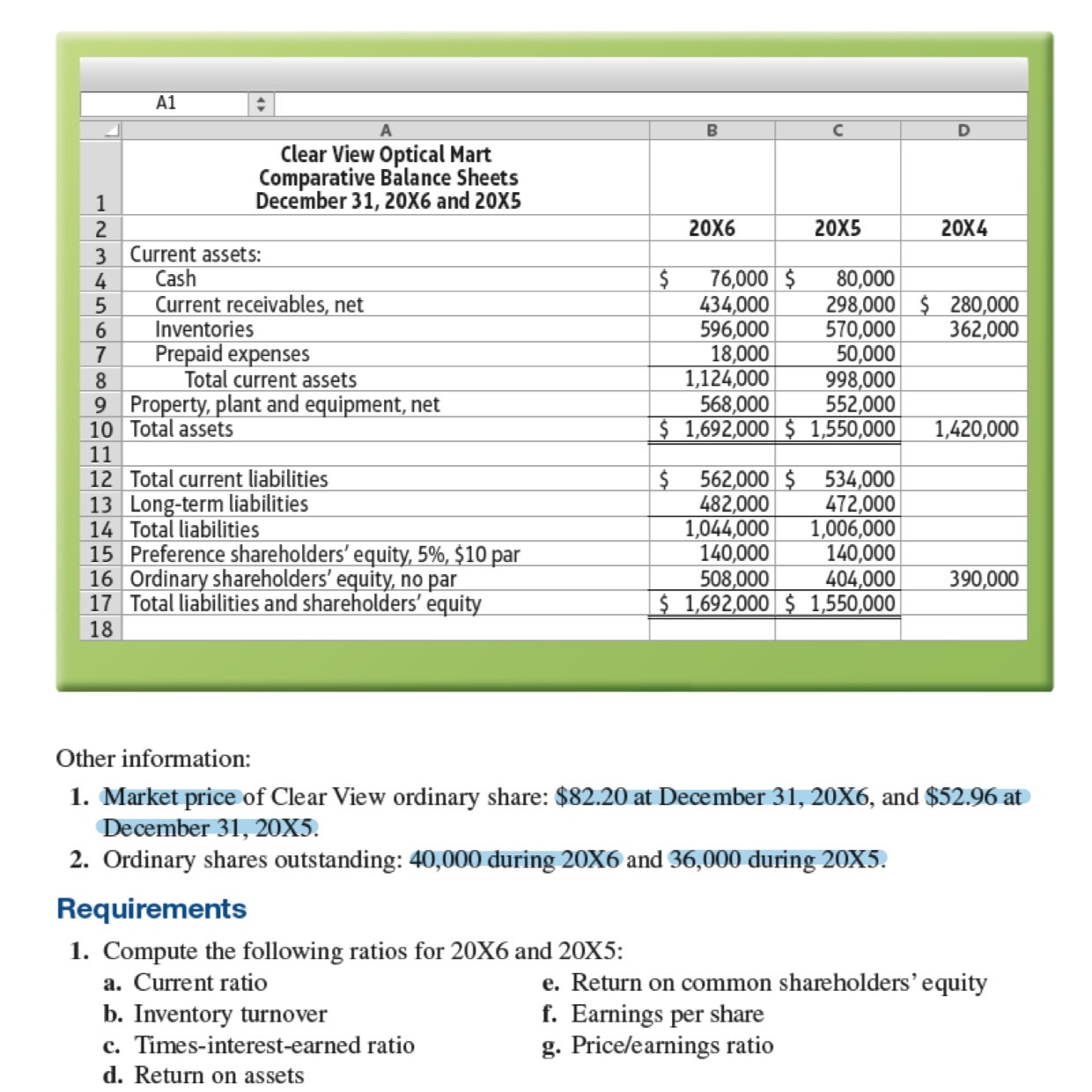

P12-55A. (Learning Objective 3: Using ratios to evaluate a share investment) Comparative financial statement data of Clear View Optical Mart follow: Other information: 1. Market price of Clear View ordinary share: $82.20 at December 31,20X6, and $52.96 at December 31, 20X5. 2. Ordinary shares outstanding: 40,000 during 206 and 36,000 during 205. Requirements 1. Compute the following ratios for 20X6 and 20X5 : a. Current ratio e. Return on common shareholders' equity b. Inventory turnover f. Earnings per share c. Times-interest-earned ratio g. Price/earnings ratio d. Return on assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts