RDP and Brothers purchased a panel truck for $25,000 on January 1, 2020. It estimated the life

Question:

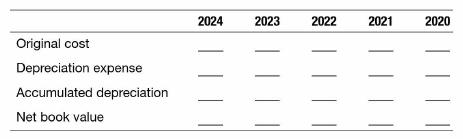

RDP and Brothers purchased a panel truck for $25,000 on January 1, 2020. It estimated the life of the truck to be five years and estimated its value to be zero at the end of the five years, and it will be depreciated by an equal amount in each of the five years.

a. In line with generally accepted accounting principles, determine the amounts required here.

b. Why did you decide to initially recognize the cost as an asset rather than treat it as an expense? What basic assumption of financial accounting are you relying upon in this decision?

c. Why did you allocate a portion of the cost to each of the five years? What basic principle of financial accounting measurement are you relying upon in this decision?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: