RDP and Brothers purchased a panel truck for $25,000 on January 1, 2017. It estimated the life

Question:

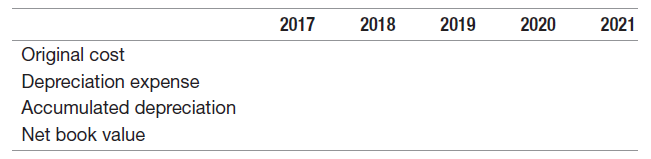

a. In line with generally accepted accounting principles, determine the amounts required here.

b. Why did you decide to initially recognize the cost as an asset rather than treat it as an expense? What basic assumption of financial accounting are you relying upon in this decision?

c. Why did you allocate a portion of the cost to each of the five years? What basic principle of financial accounting measurement are you relying upon in this decision?

2017 2018 2019 2021 2020 Original cost Depreciation expense Accumulated depreciation Net book value

Step by Step Answer:

a b Since the truck has an estimated useful life of five years it is assumed that RDP and Brothers w...View the full answer

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Analyzing a Students Business and Preparing an Income Statement Upon graduation from high school, Sam List immediately accepted a job as an electricians assistant for a large local electrical repair...

-

Upon graduation from high school, John Abel immediately accepted a job as an electrician's assistant for a large local electrical repair company. After three years of hard work, John received an...

-

Upon graduation from high school, Sam List immediately accepted a job as an electrician's assistant for a large local electrical repair company. After three years of hard work, Sam received an...

-

Consider a stylized two-period model with banking. The aggregate abatement cost function in period t is given by C(E)= (a t be) 2 /2b with a 1 < a 2 is D(E)=dE 2 /2. (a) Determine the optimal...

-

In Freedonia and Prisonia there are no taxes, and the capital markets are well-integrated across the two countries. Two multinational utility firms, FreeCorp and PriCorp, have WOSs that compete in...

-

Horton Manufacturing Inc. (HMI) is suffering from the effects of increased local and global competition for its main product, a lawn mower that is sold in discount stores throughout the United...

-

Describe a training program for expatriates. In what ways do HRIS help improve their effectiveness and efficiency? Why is it recommended that the family of the expatriate also receive training?

-

Brad Timberlake is known throughout the world for his insights on effective and efficient time management. Brad has authored several best-selling self-help books (also available in audio and video...

-

What is the value of a 1-year, $1,000 par value bond with a 10% annual coupon if its required rate of return is 10%? What is the value of a similar 10-year bond?

-

Distinguish between multilevel TDM, multiple-slot TDM, and pulse-stuffed TDM.

-

The December 31, 2014 balance sheet and the income statement for the period ending December 31 for Manpower Inc., a world leader in staffing and workforce management solutions, follow (dollars in...

-

On January 1, 2017, Barry Smith established a company by contributing $90,000 and using all of the cash to purchase an apartment house. At the time, he estimated that cash inflows due to rentals...

-

The gas-phase reversible reaction A B is carried out under high pressure in a packed-bed reactor with pressure drop. The feed consists of both inerts I and Species A with the ratio of inerts to the...

-

2.5 Use the table below and the bank statement to prepare journal entries to close the partners' Drawings accounts at 30 June 2022 to their Current accounts. General Journal of NeoZone for Kids Date...

-

Rinoldi's has a turnover of more than $20 million per annum. Their financial team of managers, accountants and financial controllers are responsible for ensuring statutory requirements are met when...

-

Expectation: demonstrate an understanding of accounting procedures for short-term assets; Instructions: Journalize the transactions below for the following short term assets. Follow the procedures...

-

Where do your products/services fit in the market? How do they compare to those of your competitors? How do customers benefit from your products/services? Place strategy Channel Product/ services...

-

How do quantitative genetics approaches, such as heritability estimation, quantitative trait loci (QTL) mapping, and genome-wide association studies (GWAS), enable the dissection of complex traits...

-

Write a debriefing statement that you would read to participants in the Asch line judgment study.

-

Give an example of transitory income. What effect does this income have on the marginal propensity to consume?

-

You are currently auditing the financial records of Paxson Corporation, which is located in San Francisco, California. During the current year, inventories with an original cost of $2,325,000 were...

-

The management of Sting Enterprises shares in a bonus that is determined and paid at the end of each year. The amount of the bonus is defined by multiplying net income from continuing operations...

-

The following income statement was reported by battery Builders for the year ending December 31, 2012: Show how battery builders would report earrings per share on the face of the income statement,...

-

Sophia operates a large singing school with 22 employees. She receives advance fee payments from students in respect of each course (a course consists of 26 lessons). If a student does not attend all...

-

What role does agency play in the Hypodermic Model of Communication? Long after the model has been abandoned by experts in persuasion and mass media, why does this model live on as common sense?

-

Daniel is a resident individual who carries on a retail business but does not use the SBE method of accounting for income in his business. On 30 June of the current tax year he had trade debtors of...

Study smarter with the SolutionInn App